Advisers wouldn’t turn up to a client meeting blindfolded – so why do some prefer to use the phone over engaging with clients using virtual technology?

This was the question posed by Andy Walton, protection proposition director at Mortgage Advice Bureau, who was speaking at the Protection Review’s ProtectX5 insurtech special event in association with iPipeline yesterday.

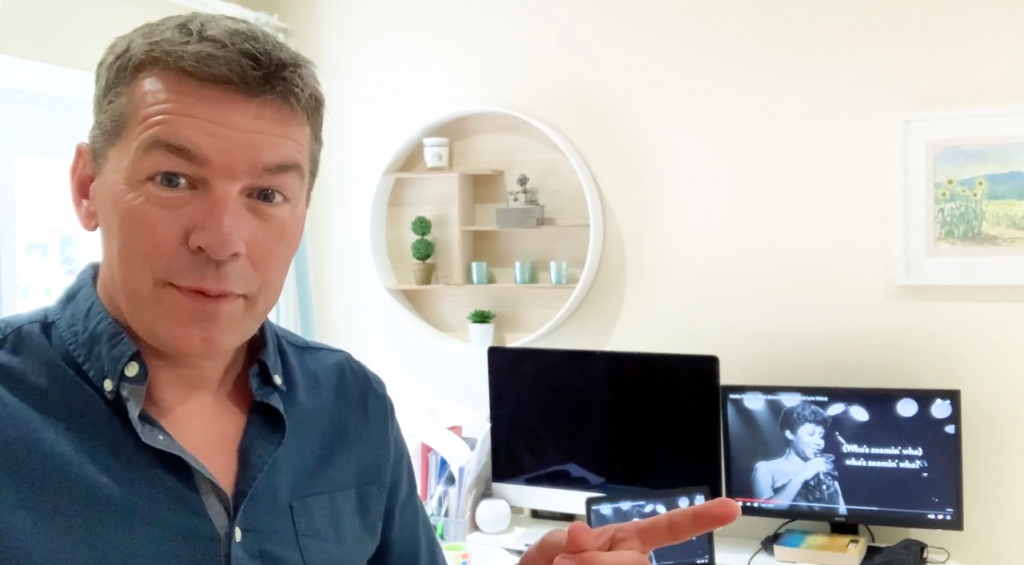

Referring to the late Queen of Soul, Aretha Franklin’s song Who’s Zoomin Who? Walton told delegates that everybody should be.

Walton explained the 500m who use virtual tech every single day benefit from the travel time saved from having to attend a meeting at another site, being able to share their screen with clients for presentations, budget planners and other displays and being able to speak to more than one person as the initial contact may not be the key decision maker.

And ultimately, Walton likened advisers who continue to prefer the phone over virtual tech to turning up to a client meeting blindfolded.

“I can’t see you – you can’t see me. Can you imagine starting off a meeting with a customer saying can you please put on this blindfold? because obviously I don’t want to look at you. you don’t want to look at me. I don’t want to see what reaction you’ve got. I don’t want to see you smiling or frowning. I don’t want to share anything with you.

“This is phone-based advice – it truly is with a blindfold and it’s crazy how we’ve got the technology that we’re doing any business whatsoever using this – using phone based advice. It is crazy…

“Look I’m here. You can see me. I can see you. I can see reactions. It is critical I believe for us to use this technology with customers where we would have been doing it face to face.”