CIExpert has launched a digital dashboard aimed at simplifying advisers’ workflow for advising in protection, within its online platform.

The Insurer Insight Zone expands on the platform’s existing comparison service to enable advisers to look more deeply into the broader aspects of each policy proposition.

It extends beyond critical illness to include information on personal and business life policies and covers aspects such as claims stats, product flexibility, age and term limits and added value services.

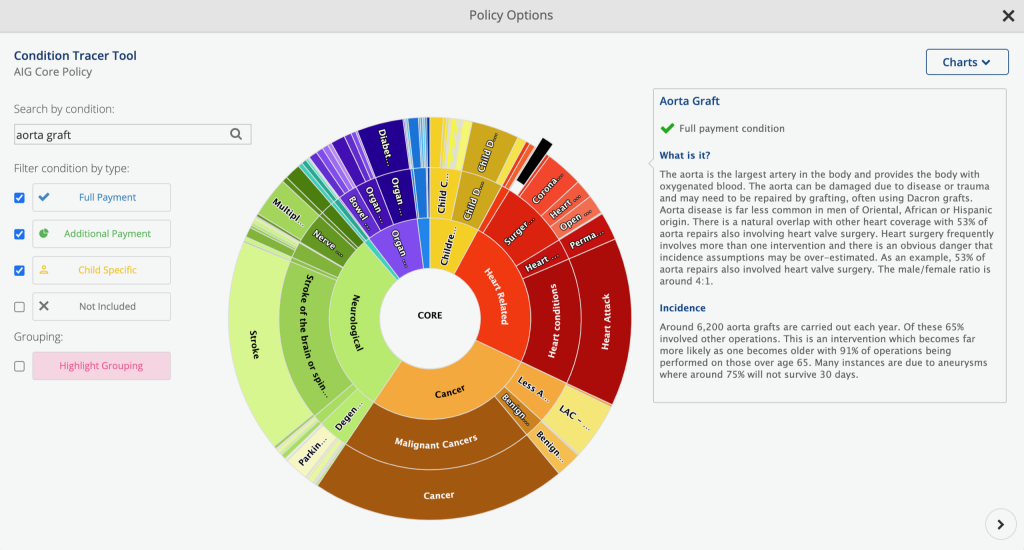

The dashboard’s design provides users with a bird’s eye view of the policy options an insurer offers, providing context for key information such as payment levels, children’s cover and the way their policies are structured.

Users are then able to drill down into the detail of features such as conditions grouping, limits, flexibility and smoker treatment when they need to focus on a particular aspect.

Features that differentiate a policy are highlighted so advisers can easily home in on the aspects of a policy that stand out and may be relevant to a particular client.

This dashboard also includes the newly developed condition tracer tool.

This tool has been developed to overcome the complexity of being presented with hundreds of conditions and complex definitions, which is often a hurdle for advisers who are hesitant about selling ciritical illness (CI) cover.

Alan Lakey, director at CIExpert, said: “We continue on our journey to provide the same richness of support tools that are available to wealth advisers to those in the protection market and we believe this is another important step.

“Over the last turbulent year we have seen wealth and mortgage advisers start to engage more in protection, however there can be no question that the complexity they are confronted with inhibits many.

“We believe these new interactive tools will serve both those that are new to protection and those that are experienced, removing the need to be hunting through policy documents.”

He added that access to insurer sales support tools was also available within the same single protection hub and that the additional service would be included at the same cost for existing users.