The Financial Conduct Authority (FCA) is starting to increase its usage of voluntary requirements – but that name doesn’t really describe what it is.

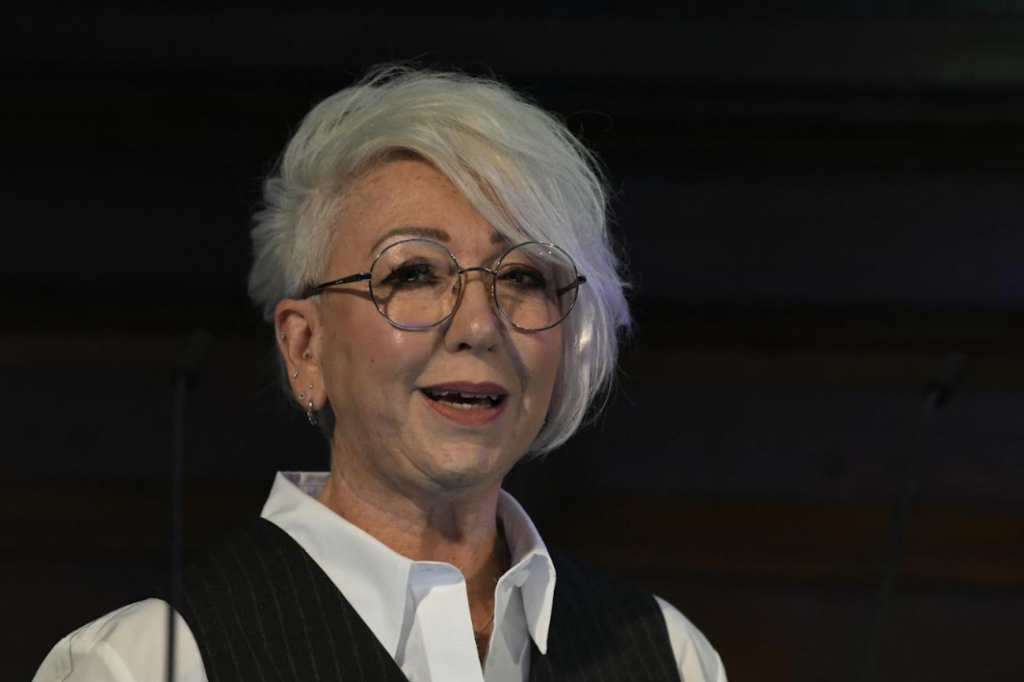

“If the FCA approach issue you with a voluntary requirement, there is nothing voluntary about that,” according to Nikki Bennett, managing director of UKGI Compliance (pictured).

She was speaking at the Association of Medical Insurers and Intermediaries (AMII) Health and Wellbeing Summit.

“You are asked to sign probably stop trading, stop selling new business – stop doing something that they are not really sure that you should be doing,” she continued.

“So if you ever find yourself in that situation, firstly take advice, get a good lawyer and also take it very seriously.

“One of the things the FCA uses it for is when they think there is something fundamentally wrong, they use the requirement to stop you doing something.

“And there is a ripple effect either from the fallout, because it will be visible in the public domain or the impact on your income.

“It can be a very easy way for them to wind down a business if they’re not happy.”

She said she had worked with some really good firms which unfortunately had to close because they could not sustain their way out of it – even though there was nothing fundamentally directed to actual customer harm.

“So it’s not a great situation to be in, but this is just the way the FCA is these days – they are wanting to do things quicker and more easily.

“They may do things that I don’t necessarily agree with, but they are focussed on trying to get us to a point where they are more confident that we are outwards focussed.”

But it wasn’t all negative as Bennett said: “They do want to collaborate and that’s a massive shift and it’s hugely positive.

“I’m really encouraged by that.”