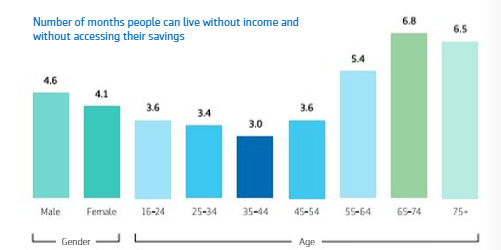

People at their outset of early middle age can live for just three months without income and accessing their main savings, according to the Aegon Financial Wellbeing Index.

The insurer’s research reveals the over 75s and people aged between 65 to 74 can live more than six months without income and dipping into their savings pot.

However, all age groups up to 54 years-old could go no more than three months without an income and needing to access their savings. (See chart)

The survey of 10,000 people across the country also revealed that women are often left behind in their financial wellbeing.

Overall, women could live 4.1 months and men 4.6 months without an income and access to savings.

The index findings are based on peoples’ responses to a range of questions measuring both their household wealth and the health of their money mindset.

Mindset measures included how healthy the social comparison people make about their money are, their financial literacy, but also factors such as whether they have a long-term financial plan, a clear picture of their future self and an idea of what makes them happy now and in the future.

The index found 42% of women were struggling with their financial wellbeing compared to 31% of men and only 12% of women were able to combine healthy finances and a positive money mindset, compared to 21% of men.

More than half (53%) of women said they did not have a financial plan, compared to 45% of men. When asked how much thought they had given to their financial goals in life 28% of women said a lot, compared to 33% of men.