Advisers working in the health and protection insurance markets have been given a reprieve from an additional £61m bill by the Financial Services Compensation Scheme (FSCS) this year, but will be the biggest contributors to overflow compensation costs of other failed firms next year.

In its latest funding update the FSCS revealed that advisers in the general insurance intermediation class, which includes health and pure protection advisers, will likely have to contribute an additional £50m to cover failures from investment and pension firms next year.

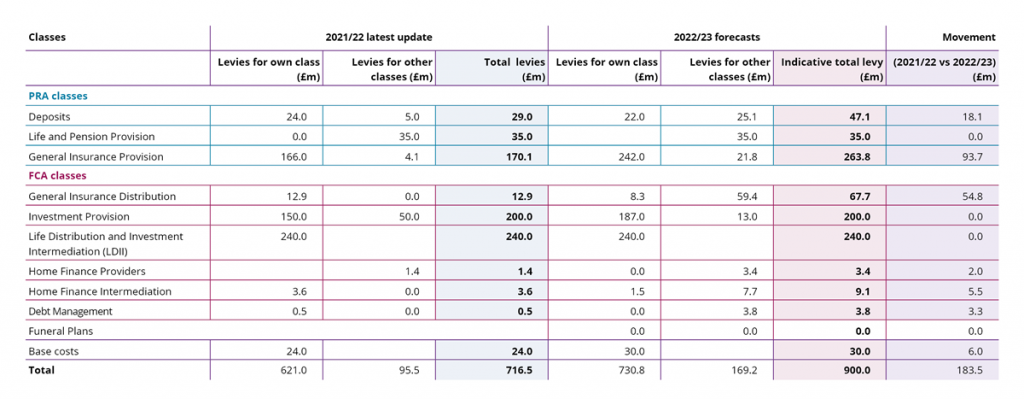

This is the biggest additional levy across the industry by far and is 7.5 times more than the £8.3m bill to cover the entire general insurance distribution sector.

It is necessary as the FSCS expects a total compensation bill of £900m next year with self-invested personal pension (SIPP) operator failures and resulting claims predicted this year merely pushed into 2022/23, rather than averted altogether.

The way the FSCS is funded has angered many in the financial advice community as low risk businesses face bailing out those firms acting in far riskier markets, and the Financial Conduct Authority (FCA) has committed to reviewing the arrangements.

Compensation down this year

In total, compensation costs for 2021/22 are only expected to reach £717m, down significantly from the £1.04bn proposed last November, the FSCS announced.

As a result the general insurance intermediation class will only pay a combined £12.9m for 2021/22 to cover its own failures – £148m less than originally planned for the supplementary funding pool a year ago.

That £148m figure was subsequently revised down to £61m earlier this year as the overall pool was reduced to £833m.

However, it appears the move is only a delay as advisers still face picking up the pieces from failures in other financial services markets with a £68m bill expected in the 2022/23 financial year. (see graph below)

For mortgage advisers who are part of the home finance intermediation class the news is slightly better.

Their total levy has dropped from £11.5m to just £3.6m for this financial year, in addition to the supplementary levy being cut, their compensation costs are around £2m lower than forecast in May.

And for 2022/23 their overall contribution will rise from a previously predicted £3.6m to £9.1m, with £8m of this going towards compensating for failures in the Life Distribution and Investment Intermediation (LDII) sector.

For next year, the FSCS is predicting:

- A significant increase in self invested personal pension (SIPP) operator compensation payouts;

- An ongoing trend of increasing compensation costs for the LDII class, including an increasing number of complex claims related to pensions;

- Increased compensation costs for the General Insurance Provision class associated with the failures of East West Insurance Company Limited and Gefion Insurance.

The FSCS is also planning for no new legal liability to be established under section 27 that, if implemented, would lead to an increase in compensation for SIPP operator claims.

And that there will be no new general insurance provider, general insurance distributor, debt management or funeral plan failures.

‘No long-term fall yet’

“At this year’s mid-point, the total levy for 2021/22 is now £717m. This is lower than our previous forecast but an increase of £17m from last year’s levy,” the FSCS said.

“This means we can now confirm that we will not be calling for a supplementary levy or invoicing the retail pool this financial year.

“We must be clear that we are not yet seeing a long-term fall in compensation costs. Instead, a number of failures we expected this year did not happen and we expect may now fall into the next financial year or beyond,” it added.

The Personal Investment Management & Financial Advice Association (PIMFA) said it welcomed the reduced levy but there were still better ways to fund compensation and that current levels were unsustainable.

“We are again calling on the government to consider the use of FCA fines to help fund the FSCS as a gesture of goodwill to an industry which has been badly let down,” said PIMFA chief executive Liz Field.

“Longer term it is clear to us that the construction of the funding model for the FSCS needs to be reformed and we look forward to engaging on this.”