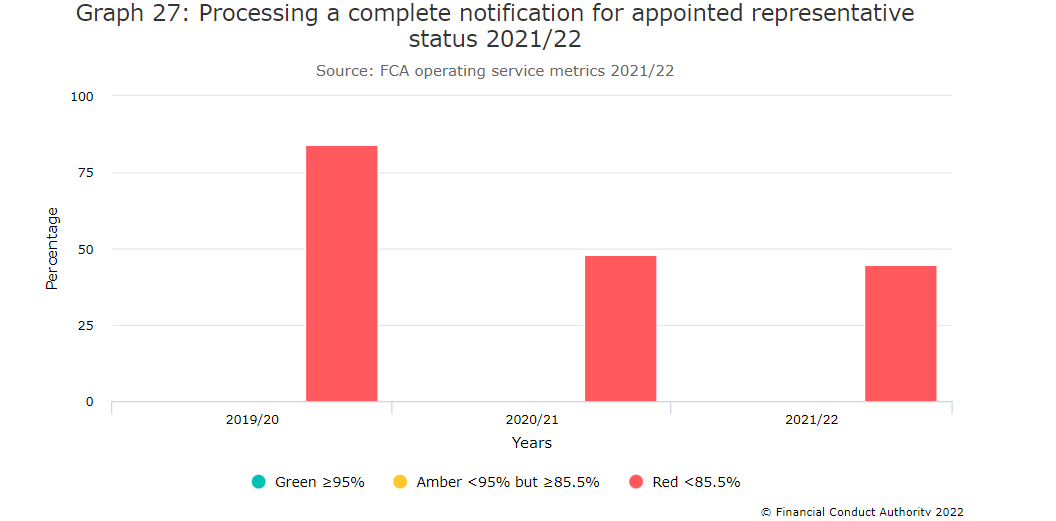

The Financial Conduct Authority (FCA) processed just 44.7% of complete notifications of appointed representative (AR) status within its target over the last financial year.

This was down from 48.1% in the financial year 2020/21 and continued the sharp fall from the 2019/20 year. The FCA’s voluntary target is to process 95% of complete notifications for AR status within five working days of the request.

The FCA said the introduction of the senior managers and certification regime (SM&CR) for solo-regulated firms and the subsequent impact of the coronavirus had driven sustained staff pressure across the teams in high-volume areas such as approved persons and appointed representatives.

This affected the time taken to process appointed representative notifications.

However, as the FCA has recruited in additional resource, both permanent and temporary, it said it had started to see a reduction in queues and expected an improvement in processing times.

The regulator added it remained committed to improving performance around processing times.

Additional resource, both permanent and temporary, has been recruited, which should contribute to an increase in the volume of applications responded to within the voluntary target.

It also said it was exploring ways in which it could improve the application process and make this more straightforward and drive efficiencies in internal processes.