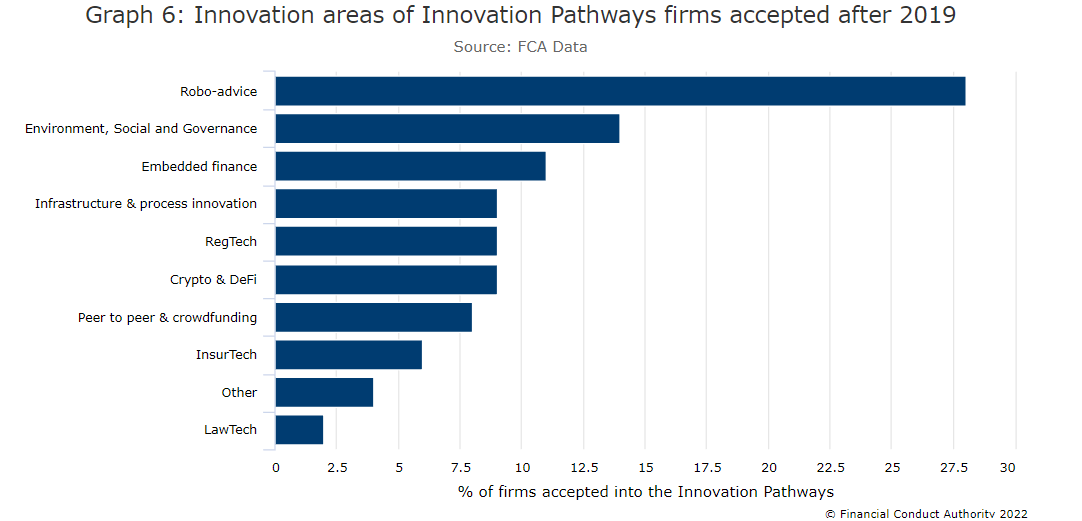

Robo-advice is the top target of firms aiming to disrupt the financial services industry through the Financial Conduct Authority’s (FCA) Innovation Pathway, the regulator has revealed.

The subject topped the list of areas being tackled by firms accepted to the pathway since 2019, according to data from the FCA.

Since its 2014 launch, the regulator’s Innovation Hub has supported a range of firms including existing firms and fintech start-ups in permitting the testing of innovative products or services in a live market or helping to resolve regulatory questions.

The data which covers firms supported between launch and July 2022 reveals around 28% of firms in innovation pathways are exploring robo-advice – more than twice the number of firms investigating the next biggest target areas, environment, social and governance (ESG) or embedded finance.

The data also points to artificial intelligence being a big driver of this activity. For Innovation Pathway firms supported after 2019, 24% used artificial intelligence (AI) and advanced analytics.

The FCA added that given its focus on the automated advice area following the publication of the Financial Advice Market Review, many AI use cases involve automated advice or guidance models developed within investment, insurance, mortgage, and debt-counselling sectors.

Robo-advice was also a popular target of firms accepted into the FCA Regulatory Sandbox testing process, with 10% investing in the area, although crypocurrencies and decentralised finance was the most popular market accounting for 28% of participants.

According to the data, 18% of sandbox firms use AI and advanced analytics. Common use cases include automated advice, back-end process automation and serving the purpose of ESG investments.

Overall the FCA has received more than 2,400 applications for support through its dual sandbox and innovation regimes. It has supported around 850 firms, including 165 firms and products which have been accepted for testing in the sandbox.

Touching on the regional location of these firms, the data revealed almost two thirds of sandbox firms were based in London, around 20% were in England outside the capital, just over 10% were international firms, 2.5% in Scotland, 1.2% in Northern Ireland and 0.6% in British Overseas Territories.

For Innovation Pathway firms the percentages were 54% in London, a third in England outside London, 7.6% international, 2.5% in Wales, 1% in Scotland and 2.5% were to be confirmed.