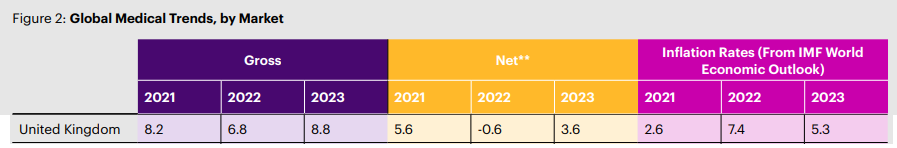

The cost of private medical insurance inflation in the UK is set to outstrip the European average and increase by almost 9% in the next year.

According to the survey of 257 global medical insurers conducted by WTW, 78% of insurers expect higher or significantly higher cost increases over the next three years, with the global average set to hit 10% next year.

The 2023 Global Medical Trends Survey found that UK private medical insurance costs are expected to increase by 8.8% in 2023, marginally above the European average of 8.6%, but significantly higher than this year’s 6.8% increase.

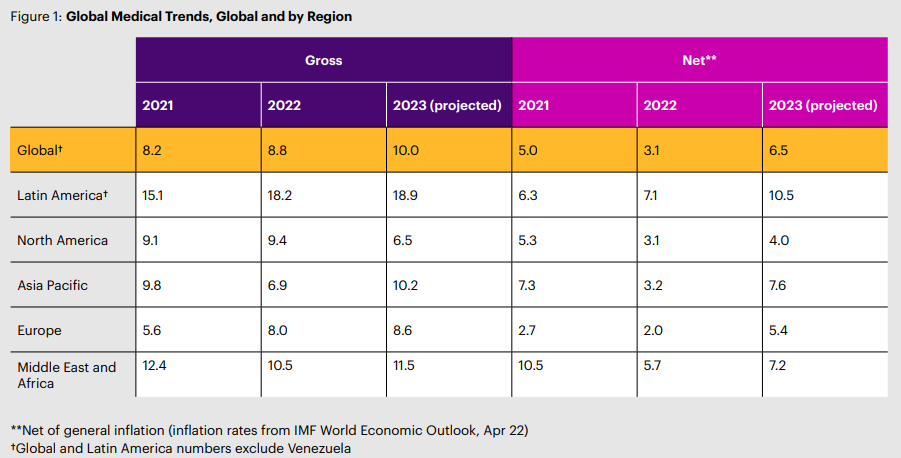

Around the world, inflation rose from 8.2% in 2021 to a higher than anticipated 8.8% in 2022 – and is projected to rise yet further in 2023 to a stubbornly high global average of 10%.

In Latin America, average increases are projected to climb from 18.2% to 18.9%, in Asia Pacific from 6.9% to 10.2%, and the Middle East and Africa from 10.5% to 11.5%.

The one region where a slowing is expected is within North America where inflation is projected to drop from 9.4% in 2022 to 6.5% in 2023, although employers are not necessarily seeing this trend yet.

The primary driver of medical costs, according to insurers, continues to be overuse of care (74%) due to medical professionals recommending too many services or overprescribing.

More than half of insurers (52%) also indicated that insured members’ poor health habits were among the top factors. The underuse of preventive services (50%) was also a significant cost driver and increased year-over-year due to, in part, the avoidance of medical care during the pandemic.

In line with previous surveys, the high cost of new medical technologies (62%) and the profit motives of providers (35%) were identified as factors affecting medical costs.

But this year’s survey also pointed to broader issues such as the decline in quality of funding of public health systems (27%) and geopolitical conflicts (19%).

MSK top condition by incidence

Insurers identified cancer, cardiovascular and musculoskeletal (MSK) as the top three conditions by cost – the same as with last year’s findings. But respondents ranked musculoskeletal as the top condition by incidence of claims this year compared with ranking it fifth last year.

Mental and behavioural health disorders ranked as the fourth leading condition by both incidence of claims and cost.

The survey also highlighted that telehealth continues to gain traction when it comes to health delivery and cost management, moving up from number three in last year’s survey to number two this year.

Insurers once again ranked contracted networks of providers (70%) as the most effective method for managing medical costs.

One-two punch

Kevin Newman, head of health and benefits Europe at WTW, said: “Worldwide inflation and a rise in healthcare use in the wake of the pandemic are delivering a one-two punch on medical costs around the globe.

“The bottom line is that these large increases are unsustainable. Employers and insurers will need to develop strategies and solutions to rein in costs to more manageable levels.”

Francis Coleman, managing director, integrated and global solutions at WTW, added: “Healthcare affordability remains top of mind for insurers, employers and employees.

“As we move into next year, we see a challenging year for employers in trying to balance the convergence of rising medical trend, salary pressures and the need to continue to make progress on DE&I initiatives globally, all while dealing with potential recessionary markets.”

WTW carried out its research between July and September 2022. A total of 257 insurers representing 55 countries participated in the survey. The US medical trend data was drawn from other WTW research.