Aviva has has been paying its longest income protection (IP) claim for more than 35 years.

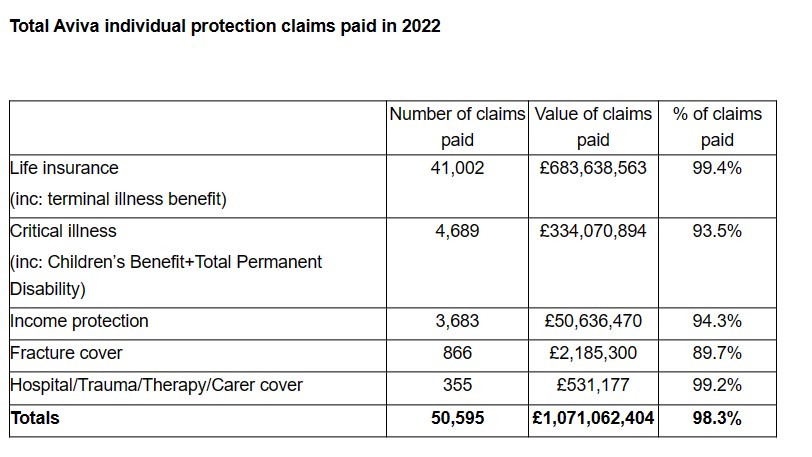

The insurer published the detail as part of its 2022 individual protection claims data which showed it paid more than 50,000 claims over the year, with more than £1bn paid out for the third consecutive year.

In total it paid more than £1,071,000,000 across life insurance, critical illness (CI), income protection (IP) and other individual protection policies, equivalent to more than £2.9m being paid out each day.

The claims paid rate of 98.3% across all policies was the highest it has reported since 2015 – the year Aviva acquired Friends Life, with a total of 50,595 claims paid to support customers and their families.

The year also saw Aviva’s protection claims team send out around 650 gifts to lift the spirits of customers going through a claim, with around 440 sent to children and their families as part of ‘Project Teddy’ initiative for children’s critical illness claims.

Life insurance

Aviva revealed more than £683m was paid out across 41,000 life insurance and terminal illness benefit claims, with 99.4% of all claims on life policies accepted.

As with previous years, cancer was the most common reason for claim accounting for a third (33%) of all death and terminal illness claims. This was followed by claims for cardiovascular disease (21%) and respiratory disease (13%).

Only 0.6% of all life insurance and terminal illness claims received last year were declined, with two-thirds of these due to the customer misrepresenting relevant information at the point of application, for example their health and lifestyle.

Critical illness including children and total permanent disability

Critical illness claims continued to rise in 2022 in a return towards pre-pandemic levels.

Almost 4,690 claims were paid by the insurer with more than £334m paid out to customers diagnosed with a defined critical illness, including just over £5m in children’s benefit.

Aviva also paid more than £294,000 in children’s hospital benefit and just under £52,000 in adult hospital benefit.

The three top causes for an adult CI claim continued to be cancer at around 58% of claims, followed by heart attack (10%) and stroke (7%).

The data also indicated CI claims for cancer were more common among women, accounting for around 72% of all CI claims by females, compared to around 50% of claims by men.

Heart attack was the second most common reason for claims by men at 18%, compared to just 3% for claims by women.

More than a third (36%) of children’s CI claims were for cancer, with haematological cancer the most common type claimed for at 46% of all children’s cancer claims.

There was an increase in the number of CI claims accepted – up to 93.5% in 2022 from 92.4% in 2021.

Around 4.3% of all claims were declined because illness definitions in the policy were not met while 1.9% were declined because the customer misrepresented relevant information at the point of application.

Income protection

Finally, when it came to IP claims – more than £50m was paid out in IP benefit in 2022 with just over 3,680 claims for customers unable to work due to illness or injury.

Aviva approved 84.6% of new IP claims received in 2022 – on par with the 85.4% and 87.5% it approved in 2021 and 2020 respectively.

The insurer said 94.3% of all new and existing income protection claims were paid in 2022, with around 2.8% declined for misrepresentation of relevant information and 1.5% declined as the policy conditions had not been met.

In addition, more than £7m was also paid in Back To Work benefit across 535 claims for customers returning to work.

During the year, 330 customers commenced early intervention support provided by Aviva’s in-house rehabilitation team or partners, with 82% of those supported having returned to their usual role and working hours at the time the insurer’s input ended.

For all customers in claim in 2022, the most common reason for claiming was mental health conditions, at 30% of all claims. Musculoskeletal claims accounted for 26% of all claims paid and cancer for 13%.

The proportion of first-time claimants who were under the age of 40 increased from 32% in 2021 to 38% in 2022. The average age at claim was 41 for women and 43 for men, both lower than the average ages in 2021, which were 42 for women and 44 for men.

The claims data showed that the longest income protection claim currently in payment has been paying out for more than 35 years. The customer claimed for mental health and to date has received more than £415,000 through monthly benefit.

Jacqueline Kerwood, claims philosophy manager at Aviva, said: “The scale of the payments we consistently make to individual protection customers year-on-year evidences the crucial financial support that our protection insurance provides for tens of thousands of UK households, especially during times of broader cost of living challenges.

“Over the last five years we have paid over £5.1bn across more than 200,000 individual protection claims, supporting UK families during the most difficult times.

“While we have a consistent track record for paying out claims, we are equally focused on going above and beyond our customers’ expectations of their policies and their cover.

“We will be sharing Aviva’s Individual Protection Claims Report and hosting adviser webinar events in May, which will provide compelling evidence for advisers to share with customers when discussing the importance of having and keeping protection insurance in place.”