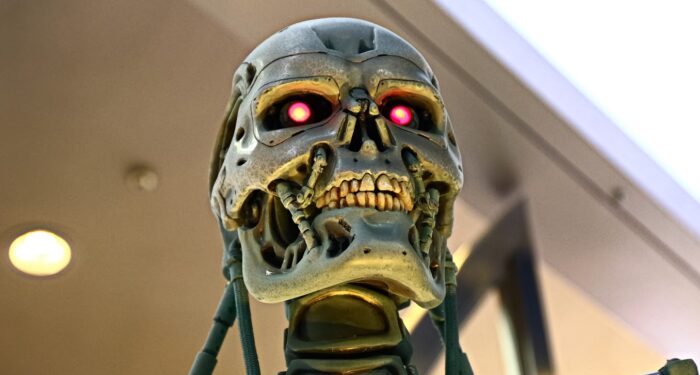

The 1984 cult classic movie The Terminator painted a picture of a future in which robots were fighting humans for control of the planet and sending back assassins from the future to eliminate the saviour of post-apocalypse mankind.

Fast forward 40 years or so and James Cameron’s vision of the future has not quite yet materialised. But artificial intelligence (AI) has even put to use to create a new Beatles song and a tech expert is warning AI will affect all industry – not just the world of health and protection. So, could this technology eliminate the role of the adviser entirely?

Platform providers clearly point to a present and future in which advisers are increasingly embracing technology to create more seamless customer journeys for clients.

There is growing interest in assessing applicants beyond standardised criteria. Wearable tech and chatbots could play a role in providing more accurate data from clients’ health and to get more routine customers questions out of the way early on.

But while the march of the machines cannot be ignored, could the future be one in which adviser and robot work side by side to deliver a more blended solution for customers?

AI likely to affect all industries

“Hundreds of millions of words have been dedicated to, and written by, AI in recent months, as ChatGPT and Google Bard prove their ability to process huge amounts of data and manage the nuances of language,” Paul Yates, product strategy director at IPipeline, tells Health & Protection.

According to Yates, this technology is likely to affect almost every industry – and the advice market is no exception.

“In the short to medium term, I see ChatGPT, Bard and any others as great enablers, helping advice businesses to increase their bandwidth by hitting the accelerator on tasks such as outbound client comms, blog posts and social content,” Yates said.

“As such, technology could aid better engagement and customer understanding.

“In the long term, who knows what the impacts might be not just for the advice market but for life and business in general?”

Generating value for advisers

Jacqueline Durbin, global head of product – life, pensions and mortgages at Iress, predicts AI will play a “major part” in generating value to advisers.

“The potential for it to be used to create scenario or matrix quotes, improve the customer journey and provide more contextual and ‘just in time’ information is very exciting,” Durbin added.

“Underpinning all that is data and analytics that allow providers to tailor policies and streamline the underwriting and claims process, helping create better choice architecture and thus more relevant options for customers.”

According to Durbin, Iress is also seeing “huge” interest in personalisation – assessing each applicant on more than just a set of standardised criteria.

She cites the examples of Body Mass Index (BMI) being used as an assessment measurement and making smoking and non-smoking criteria far more nuanced, as well as highlighting particular product features and unique selling propositions that may be of particular interest to the client.

Increased use of wearable tech

Durbin adds that this trend towards more personalisation in quotes and underwriting also means wearable tech may start to become embedded in the quote process.

“The technology should allow personalised data to help customers get better cover,” she continued.

“For example, a customer may have been excluded because of a health condition, but lifestyle and fitness data could provide information that allows a better underwriting outcome.”

Phil Nash, director of sales at UnderwriteMe, agrees, as he expects further integration of wearable tech to support protection applications.

But Nash added there are further efficiencies to be gained from streamlining elements within the application process such as investigating how to speed up turnaround times where further medical evidence from patients is required.

Other trends Nash points to include the sector continuing to provide as many ‘buy now’ decisions as possible at point of sale and using technology to maximise the ability to offer cover to customers where historically no cover was provided.

Using tech to improve customer experience

But what is the view from advisers?

According to Debbie Kennedy, chief executive at LifeSearch, continually developing technology – both in-house and from suppliers – that enables seamless transactions across the customer journey is a “key focus” for the firm.

Kennedy maintains technology should be a core enabler to the customer experience.

“Having a one-size customer journey is not good enough. Customers move from device to device, from various communication platforms such as What’sApp, chat bots, email and phone, switching between offline and online, so ensuring journeys and experiences are designed around customer needs is crucial,” Kennedy continued.

Joanna Streames, managing director at Velvet, revealed her advice firm’s embrace of technology has even extended to the development of its own app.

“At Velvet, we felt compelled to embrace the emerging trend for conversational chatbots by going digital ourselves with our own Velvet Connect digital app,” Streames revealed.

“We wanted to have better client engagement and nurture our existing relationships. Our app now means we can engage with clients easily and frequently. They can upload documents securely for peace of mind and can check their policies/mortgages with us at a glance.

“The uptake and response has been encouraging – so we are really glad we have taken the leap. I believe that we should all be looking for ways to improve and remove stress for ourselves and our clients.”

But Streames adds she does not think the whole process of taking out cover should be digitised.

“I don’t believe the whole process should be a digitised end to end. For me, it’s all about striving to get the right blend of humans and tech and that makes for perfection in my eyes and what we should all be aiming for.”

For Kennedy ever more intelligent use of AI and machine learning has the potential to both allow advisers to be more strategic and deliberate in how they make contact with customers and ever more consistent in the solutions provided.

“Continuous improvements in natural language processing will hopefully allow ever more thorough and accurate analysis of adviser/customer conversions at higher volumes to continue to enhance quality of advice too,” Kennedy added.

“Clearly the advances in AI-based chat bots pose the question around what advice looks like in the future. How much could be automated vs human to human? If advice is formed only of data rather than opinion of individual advisers we all need to consider what constitutes advice.”

It’s not about replacing advisers

And with the Financial Conduct Authority’s Consumer Duty coming into force this year with its associated focus on consumer protection, a “less black and white” way of assessing applications seems to be the logical next step, Durbin adds.

“When this happens, I’m expecting to see the behavioural shift from consumers continue, where protection becomes an essential rather than an afterthought,” Durbin continued.

“This personalisation will be far easier to achieve with the aid of AI – and this isn’t about the replacement of advisers with a machine. It’s about data and analytics supporting better decision making process and generating better customer insights.”