Association of Financial Mutuals (AFM) members paid out more than £70m in claims to 7,000 customers in 2023.

This compares to £52m in claims in 2022.

Part of the increase is linked to Wesleyan Assurance rejoining AFM in 2023. On a like-for-like basis, the amount paid out in 2023 was 6% higher than in 2022.

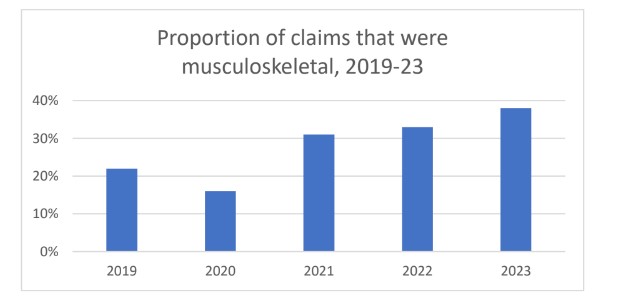

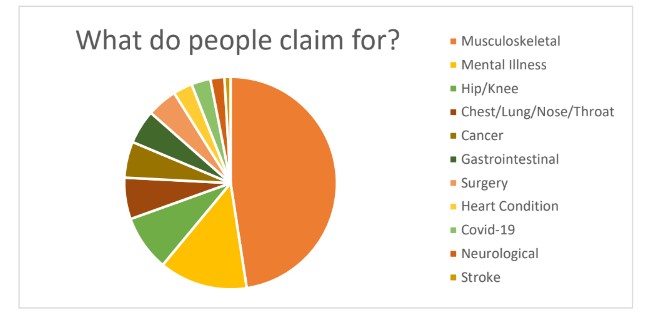

The most common form of claim was musculoskeletal (38% of all claims).

While these claims were also the most frequent in previous years, the rate of increase is significant, as demonstrated in the chart below.

There was also a sharp increase in the number of claims relating to mental health, rising to 11% in 2023 compared to 8% in 2022.

This coincides with a report from the Centre for Mental Health, which indicated that the economic and social costs of mental health rose to £300bn in 20221.

Around 90% of mental health claims are for stress, anxiety and depression, though claims for PTSD and eating disorders were most costly, averaging £56,000 per claim.

Members offering income protection products now account for around 60% of claims on individual income protection products.

While the average duration of claims in 2023 for income protection policies was 68 weeks, nearly a quarter of claims have been running for more than five years.

The average value for each claim was just over £10,000. In addition, AFM members also intervene to help claimants recover, and undertook rehabilitation with nearly 600 people in the year.

The proportion of claims approved was 92.1%, up from 91.6% the previous year.

The main reasons for claims to be declined were those where key information was not disclosed at the point of application or claim (54%), with a further 26% not paid because the claim did not meet the definition of disability.

Andrew Whyte, CEO of AFM, (pictured) added: “According to the FCA’s Financial Lives survey, 6.1% of the population hold an income protection policy.

“AFM members are becoming an increasingly important part of the market, managing around 400,000 policies at the end of 2023, just under 15% of the market, but they accounted for over 60% of all claims paid to individuals.

“We expect the mutual influence to continue to grow: in 2023 ABI reported total sales of income protection of 247,0003, with 57,000 new policies (or 22% of the total) sold by AFM members.

“Affordable premiums and a greater likelihood of paying a claim are key reasons in the growth of the mutual market.”