Royal London has overhauled its protection underwriting for cancer survivors with some applications for those who had early stage tumours now being available on standard terms.

The changes enable Royal London to expand the instances it can offer terms for critical illness (CI) and income protection (IP) where in the past it may have been unable to do so.

The insurer said it had introduced the approach to cancer underwriting aimed at broadening access to cover and helping to address the protection gap for those who have previously been diagnosed with cancer.

It added it was also amending life cover outcomes to reflect current evidence in order to allow for improved terms for customers who have previously had a range of different cancers, including breast, colorectal and skin and prostate.

Royal London told Health & Protection it has reviewed its entire underwriting approach for all cancers and has provided updated outcomes.

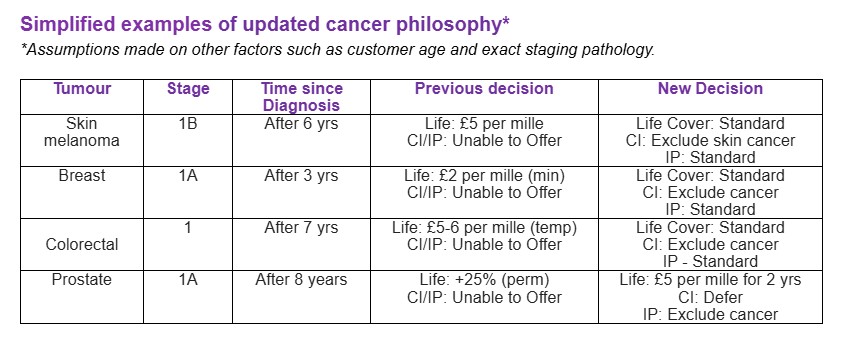

It explained that the table (below) shows some examples of the changes in decision.

It said the key change is that more customers will now be able to access cover for critical illness and income protection usually with an exclusion, when they would have previously been declined.

In some cases customers will now be eligible for standard rates having previously been offered loaded premiums, it added.

Craig Paterson, chief underwriter at Royal London, (pictured) said: “Improving cancer survival rates has led to a growing protection need for those who have previously had the disease that could also help address the protection gap.

“It’s important we continue to keep pace with medical advancements to offer fair and accurate decisions that benefit customers with a history of cancer.

“The changes we’ve made are part of our commitment to provide evidence-based outcomes and to broaden access to insurance by offering cover to as many customers as we can.”