HSBC Life UK is expanding its value added benefits (VABs) to include policyholders’ partners. This includes spouses, civil partner, or co-habiting partners.

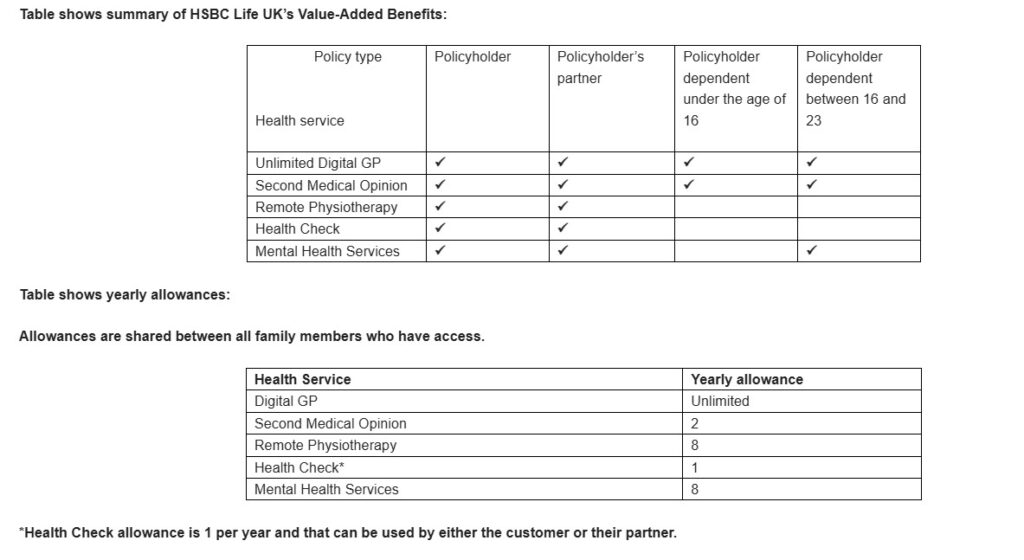

Benefits include mental health services, unlimited 24/7 digital GP, second medical opinions, remote physiotherapy, and an annual health check.

The benefits are available to HSBC Life UK’s existing and new protection customers who purchased their cover via intermediary distribution partners including price comparison websites.

Policyholders’ dependents also have access to digital GP appointments and second medical opinions.

Dependents aged 16-23 will be eligible for mental health services.

Services are provided by Square Health. The selection of these services is a non-contractual benefit and are not part of the insurance cover the policy provides.

Richard Waters, head of protection distribution at HSBC Life UK, (pictured) said: “We understand the importance of staying at the forefront as a leading protection provider.

Richard Waters, head of protection distribution at HSBC Life UK, (pictured) said: “We understand the importance of staying at the forefront as a leading protection provider.

“That’s why we are constantly evolving our protection proposition.

“We believe it is really important that our customers are able to maintain their wellbeing by knowing how to access and use these value added benefits.

“As such, we distribute a reminder on the six month anniversary of customers’ policies, and we include details of the benefits in their annual statements.

“We want our customers to use these services for prevention rather than cure.”