More than a third of firms (34%) are finding evidencing outcomes for vulnerable customers as required by the Financial Conduct Authority’s (FCA) Consumer Duty board reporting requirements to be “extremely challenging”.

This is according to the findings from research conducted by the Chartered Insurance Institute (CII) in conjunction with FWD Research this summer, which also found 21% of firms surveyed said there remains a data gap in understanding vulnerability.

Board reports

The research features in a CII White Paper that seeks to support firms’ compliance with the FCA’s reporting requirements under the Consumer Duty.

Every regulated firm is required to produce a board report, at least annually, to record its progress in achieving the customer outcomes set out by the FCA.

With the rules effective from July 2023, the first board reports were due by 31 July 2024.

The CII partnered with FWD Research in July to ask members of the Institute directly involved in board reporting about the challenges they had encountered in producing these first editions. This included finding, reconciling or generating data.

Quantitative results

The research sought to identify key challenges experienced by those directly involved in evidencing outcomes or contributing to writing their firm’s board report during July 2024.

An online survey gathered 144 valid responses between the 10th and 26th of July.

It used an initial cut of these results to inform a roundtable discussion with nine representatives of CII member firms under the Chatham House rules on 24 July.

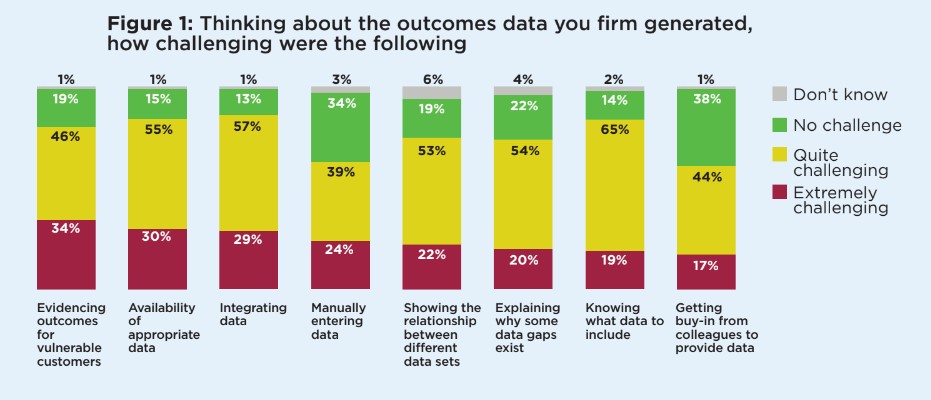

The CII first asked respondents what the biggest challenges had been when gathering data to measure and monitor customer outcomes.

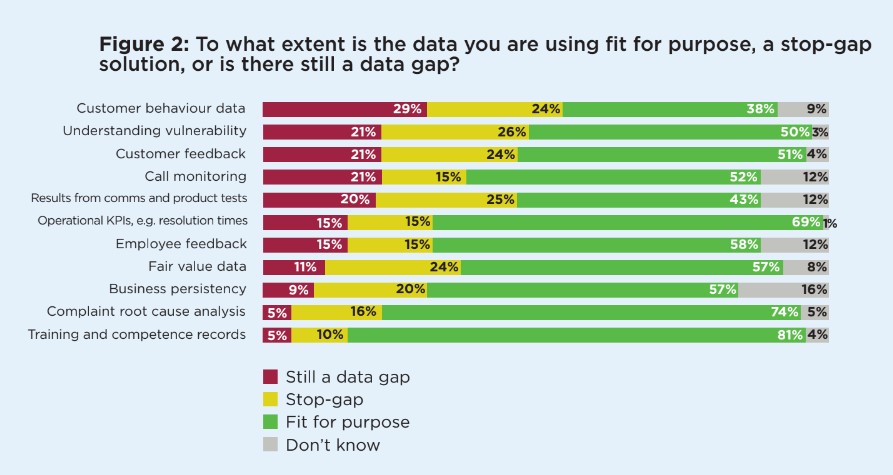

It then asked respondents where they still had data gaps in their reporting, where they were using stopgap data and where they were confident they were using fit-for-purpose data.

Respondents highlighted evidencing outcomes for vulnerable customers as their most significant challenge, with 34% stating this was extremely challenging.

This is a key requirement of the Duty and the focus of the Vulnerability Review announced by the FCA on 14 March.

But the availability of appropriate data also emerged as a closely related issue, with 30% stating this as extremely challenging.

The biggest data gaps – where over four in 10 firms are using stop-gap data or have no data – related to customer behaviour, understanding of vulnerability among their client base customer feedback, or results from communications and product testing.

Though training and competence and complaint root analysis data were considered fit for purpose by 81% and 74% of respondents respectively, the CII said this might indicate a degree of overconfidence in this first round of board reports, until the sector better understands what the FCA deems as suitable evidence.

The next two biggest challenges were integrating data and showing the relationship between different data sets – the causal relationship referred to by the FCA in their recent review of Insurers outcomes measurement.

More help needed

Those who attended the CII’s roundtable also said they would welcome advice on storing and sharing information on these customers, given the need to meet other legislative requirements, such as general data protection regulation (GDPR) rules.

While some firms expressed concerns to the CII about how much time was being invested in the reporting process, others said it had helped to shape internal conversations that had already driven positive changes for their customers.

But in any event, most firms said they would welcome more guidance from the regulator on how they should meet the reporting requirements.

Recommendations to better implement Duty

Consequently, the White Paper makes recommendations to help firms better implement the Consumer Duty and sets out areas based on the findings.

These include:

- That firms should ensure that data and reporting requirements are used not only to satisfy reporting requirements, but are baked into product, service and process improvement cycles, as well as the design stage for new products, and are used to create the causal chain the FCA has identified as best practice

- That firms are encouraged to work with professional bodies to develop research best practice, for example on survey methodology and the analysis of unstructured conversations, so that the benefit to consumers is as broad as possible

- That firms identify whether they have a robust understanding of vulnerability for their customer base that enables them to develop informed vulnerable customer strategies that will lead to good outcomes for all customers, including those with characteristics of vulnerability

- That firms place more emphasis on joining the data dots around individual customers or customer groups in real time, challenging assumptions and exploring data insights across multi-disciplinary teams to effect positive change for them

- That leadership teams in firms take active interest in reviewing customer needs for each of their entities, being the voice of the customer, to ensure continuously improving outcomes are prioritised

Discussions with FCA and wider sector

But the CII added it also intends to have discussions with the wider sector, including the FCA.

Areas of discussion include:

- How well the Duty is serving the customers originally considered to be in scope, and whether any changes are required as a result

- How the sector can collectively support firms to understand the characteristics of vulnerability and identify vulnerable customers

- Whether the sector can support the production of more guidance to help firms understand what data they should be storing about vulnerable customers, for how long, and with whom it should be shared

- Whether the sector can support the publication of interpretations of the Duty that relate to specific sectors – such as around data principles, good practice or codes – to remove ambiguity, encourage reporting consistency and generate greater sector efficiency

- Whether the sector can support the introduction of a core set of metrics against which all firms should be expected to report as a minimum

Further action

Over the next few months the CII added it will be introducing solutions to help insurers and brokers better implement the Consumer Duty.

The first initiative, completed with FWD Research, is aimed at helping members meet the FCA requirement to conduct a top-down survey of their customer base so that they can understand vulnerability and develop informed vulnerable customer strategies.

Understanding challenges

In his foreword to the White Paper, group CEO at the CII, Matthew Hill, said: “The Chartered Insurance Institute sought experiences of writing these initial reports to understand any challenges that might have been encountered, and to make recommendations that might assist other firms in future.

“We are sharing our findings and recommendations with the FCA and the wider sector through this White Paper, and we will continue to explore with the regulator and our members what more we can do to assist firms in meeting the standards of care expected from the introduction of the Consumer Duty.”