Bupa’s pre-tax profit rose more than 70% to almost £1bn in 2024, however its UK and Global insurance division saw profits slip 15% over last year.

Bupa’s group pre-tax profit hit £972m, up from £564m in 2023, while its total customer base grew by more than 10 million people to 60.5m customers compared to 50.0m in 2023.

The UK Insurance business contributed to the user increase, with more than 485,000 net new customers across medical insurance, health trusts, dental insurance, subscriptions and cash plan in 2024.

Bupa UK Insurance currently has about with 3.9m customers.

The surge in profit for the group was driven by its Asia Pacific and Europe and Latin America operations.

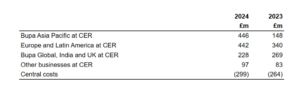

Bupa Asia Pacific became the most profitable arm of the group with operating profit of £446m, up from £148m, followed by Europe and Latin America with an operating surplus of £442m up from £340m.

Bupa Global, India and UK

The Bupa Global, India and UK market unit was the only one to see underlying profit reduce despite higher revenues and investment returns, dropping to £228m from £269m in 2023.

Bupa said UK Insurance profit fell due to higher commission payments and claims during the year, and not conducting another post-Covid rebate to customers in 2023.

“In UK Insurance, profits reduced due to the timing impact of the return of premium provision release in the prior year, which offset the tail end of deferred Covid-19 claims, some of which arose in the first half of 2024,” Bupa said.

It was also “driven by the timing impact of the return of premium provision release and commission expense timing on strong gross written premium growth”, it added.

But Bupa said the launch of Well+ health subscriptions to business and consumer customers had provided more people access to digital health and wellbeing support, including GP, mental health and physiotherapy appointments.

It also added that it had introduced a new dental allowance for all consumer health insurance customers to be used for an appointment and treatment at its Dental Care practices.

The insurer added that Bupa Global was serving around 400,000 IPMI customers.

Bupa noted its Niva arm in India had around 19.6m customers and its annual loss rise was due to acquisition costs and no in-force profit earning in the period having recognised it at fair value on acquisition.

In January 2024 Bupa increased its investment to become the controlling shareholder in Niva Bupa.

Subsequently, in November, Niva Bupa successfully listed a minority shareholding via IPO and raised additional capital, marking a new step in the growth of the business.

Strong progress

Group CEO Iñaki Ereño said: “We have made strong progress over the past year, growing our business to support more customers across health insurance, health provision and aged care.

“We have continued to focus on improving our customers’ experience and have expanded our digital health solution, Blua, which is now available in all our major markets.

“Our 3×6 Strategy, which ran from 2021-24, has enabled us to accomplish a lot this year in support of Bupa’s purpose: helping people live longer, healthier, happier lives and making a better world.

“While we have made significant progress, we know there is still more we can achieve. We are excited about our new strategy for 2025-27 which will help us to further deliver against our purpose.”