WPA has extended its group deductible model to its claims rated Absolute Health product for medium sized firms with 150 to 1,000 employees.

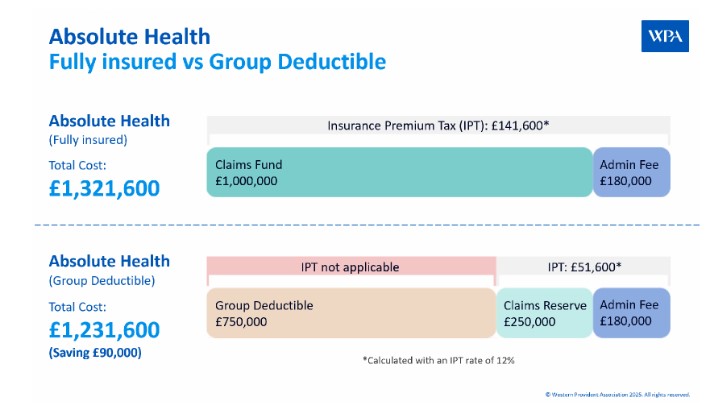

The provider said this typically offers companies a saving of 6% against a comparable fully insured premium as it reduces the Insurance Premium Tax liability through use of a large deductible.

The group deductible can be added at inception or renewal and also aims to give employers a lower P11D cost per employee..

The corporate deductible model was introduced in 2010 for bespoke schemes and later added to the Precision Corporate Healthcare product for SME businesses.

The group deductible acts as an alternative to traditional fully insured models with guaranteed savings.

WPA said by splitting the payment into two components – a capped, collective excess (the deductible) and the remaining insured element, the model aims to give companies greater control, reduced overall costs and no additional risk.

In lower claiming years where the deductible element is not fully used, the model aims to further benefit companies with the surplus being returned as a credit thereby making the arrangement cost-effective with the additional bonus of a potential refund, WPA added.

Ellis Turley, head of large corporate customers at WPA (pictured), said customers could benefit with not only Insurance Premium Tax savings but, if they have a good year, they get money back.

“With so many upward cost pressures upon companies, we are challenging the notion of insuring known costs,” he said.

“Group deductible could be a gamechanger for mid-large corporate claims rated schemes.

“In a challenging year, whilst benefiting from a lower Insurance Premium Tax bill, they are safe in the knowledge that they are protected under the umbrella of an insurance policy – better still, an added advantage of the premium savings is the knock-on impact to employers’ National Insurance liability.

“With the group deductible option selected, large employers can make substantial savings without compromising on the quality of care for their people. It’s about giving businesses more control and value from their healthcare spend.”