Everyday accidents and illnesses have risen year-on-year, prompting more hospital admissions, according to MetLife UK’s Everyday Risk Report.

Visits to accidents and emergency (A&E) have increased 3.8% and hospital admissions have increased 7%. This increase is far in excess of the estimated 1.2% population growth, which MetLife says suggests that the UK population is more accident prone than ever before.

However, the research also found that just one in 10 (10%) have an accident and sickness policy which would provide financial support when needed most should they become injured or unwell.

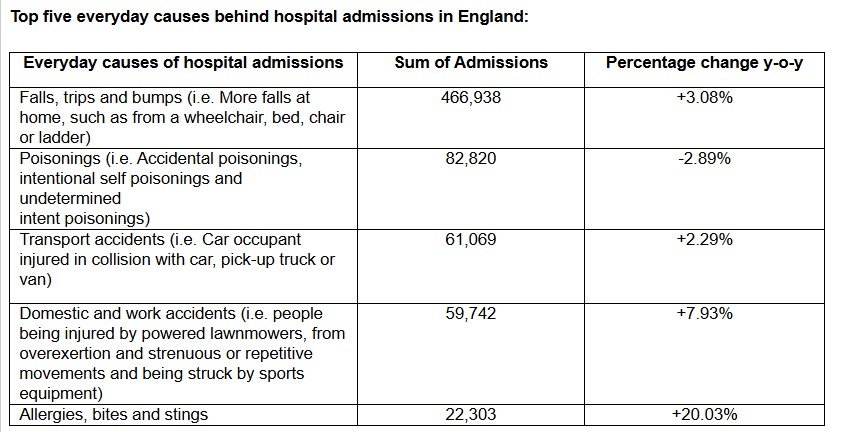

Falls, trips and bumps stay top of the list when it comes to the most common ‘external causes’ behind hospital admissions in England, with an extra 13,934 people (3.1%) experiencing these types of accidents compared to the year before.

But bites, allergies, and stings have seen the largest increase in the number of people who have been admitted to hospital for this reason.

For its research, MetLife linked existing data with research into how many people have suffered injuries from accidents and experienced serious illness.

Two in five (42%) were revealed to have suffered an injury that saw them admitted to hospital for 24 hours or more.

When it comes to the injuries that Brits have sustained, broken bones ranked top (45%), followed by a muscle or ligament tear (20%), concussion (16%), or the loss of use of one of their joints (8%).

These injuries were the result of a number of everyday accidents, and the most common were tripping or falling over (36%), a sporting activity like running or football (23%), or falling down the stairs (17%).

On average, adults who have had an accident spent four days in hospital, although almost one in five (19%) spent more than this, and just over one in 10 (12%) spent more than a week.

Along with the time taken to physically recover, this has potential financial implications too, such as taking time off work, paying for general expenses while in hospital, or parking costs.

The research was conducted among 3,001 UK adults – with at least 2,000 employees (full time or part time) across any sector/seniority/company size and at least 250 respondents who have been admitted to a hospital because of an accident or serious illness at any point in their life.

Phil Jeynes, head of individual protection at MetLife UK, (pictured) said: “Just a year on from our first Everyday Risk Report, we’ve seen the number of injuries and hospital admissions increase as a result of everyday accidents.

“Even falls or trips, the most common every day cause behind hospital admissions, are overlooked as a major risk in people’s lives.

“What is striking is how many people are still not appropriately protected against these risks.

“Behind every statistic is a person, a family, a story of uncertainty, and it presents a clear need for individuals to have the right type of protection in place to safeguard them. That’s why we strive to offer simple protection products that are an everyday essential.

“Providing a reliable financial safety-net that can support them and their loved ones when life takes an unexpected turn, helps ease the financial strain and lets people recover and deal with the things that matter most.”