Protection sales dipped slightly in the second quarter of the year as income protection (IP) growth eased and guaranteed whole of life business collapsed, according to Gen Re.

However the reinsurer’s figures were more positive for a stabilising critical illness (CI) market and showed a sharp increase in value of underwritten whole of life coverage taken out driven by pending Inheritance Tax (IHT) changes.

As a result, following a more buoyant Q2, the overall protection market is largely unchanged in the number of policies sold during the first half of the year.

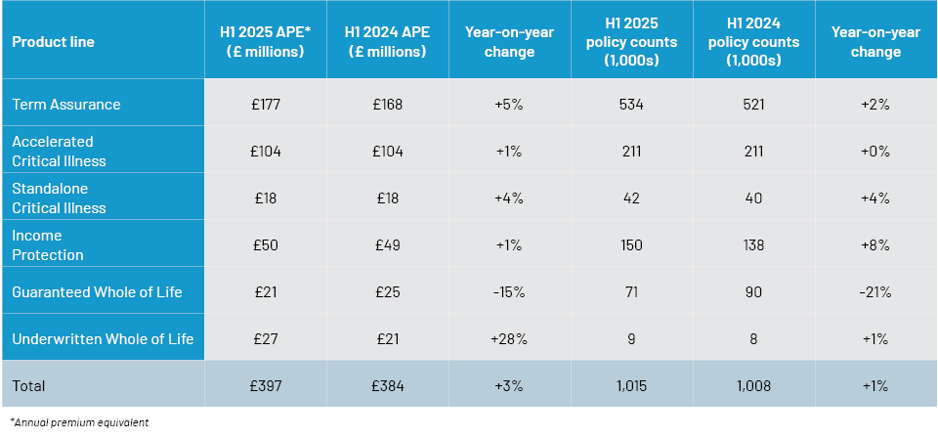

Gen Re’s figures showed 1,015,438 new protection policies written in the first six months of the year – up 0.7% or 7,042 from 1,008,396 a year ago.

However, Q2 sales slipped by 2.3% or 11,585 to 484,019 from 495,584 completions. This was also a notable drop of 47,399 or 9% from the 531,419 sold in the first three months of the year.

IP growth slowing

Gen Re noted that the market was continuing to see a slowing down in IP sales – most notably in value of cover purchased.

The number of IP policies sold in H1 grew again to around 150,000, but this rise of 8% was half the 15% in the same period of 2024 and far below the 21% increase in H1 2023.

However, in value of cover, IP sales grew by just 1% to around £50m by annual premium equivalent (APE) – down from 3% growth in 2024 and 31% in 2023.

“The relative difference in growth rates may be down to increased engagement from younger customers and hence an increase in policy count,” the reinsurer said.

“This demographic may be likely to take out policies with lower sums assured than those in the older age group to whom insurers have traditionally sold IP policies.

“If this is one of the drivers of increased sales by policy count, this certainly would be very encouraging for the industry, where there have been significant efforts to engage the younger demographic,” it added.

CI recovery

Gen Re also highlighted a recovery in accelerated CI sales over the quarter leaving the 211,000 policies sold and APE figures largely unchanged from a year ago.

Meanwhile standalone CI policies continued to grow from a lower base – up 4% in H1 with 42,000 completions.

The reinsurer noted an uptick in term assurance sales of 2% by policy count and about 5% by APE compared to H1 2024, likely through improved mortgage business.

“The growth seems to be driven by the mortgage market, with our data showing an increase in term assurance being used to protect mortgages,” Gen Re said.

“The FCA’s mortgage lending statistics are also showing a substantial increase in mortgage advances: Q1 2025 was 54% higher than Q1 2024,” it added.

Contrasting whole of life markets

The whole of life markets have undergone sharply contrasting fortunes.

Underwritten whole of life experienced strong growth by APE in H1 2025 compared to H1 2024 – up 28% to £27m – but new policy numbers are only up 1% to 9,000.

The reinsurer said this was “largely driven by a renewed emphasis on IHT planning following recent budget changes”.

“With upcoming reforms set to include pensions in the IHT calculation and reductions in reliefs on business and agricultural assets, many individuals are seeking reliable ways to protect their estates from tax liabilities,” it said.

“The number of policies remains stable from H1 2024, indicating a rise in the level of sum assured per policy.”

In contrast, the guaranteed market has somewhat collapsed with new policy sales down 21% and APE down 15%, with concerns over value for money and regulatory intervention through the Financial Conduct Authority’s market review.