Insurers expect health benefit claim costs increases to exceed 10% in most global regions for a sixth consecutive year.

However, for the first time in four years insurers expect a shift towards employers cutting coverage to manage these costs.

This is according to Mercer Marsh Benefits’ Health Trends 2026 report which surveyed 268 insurers across 67 markets.

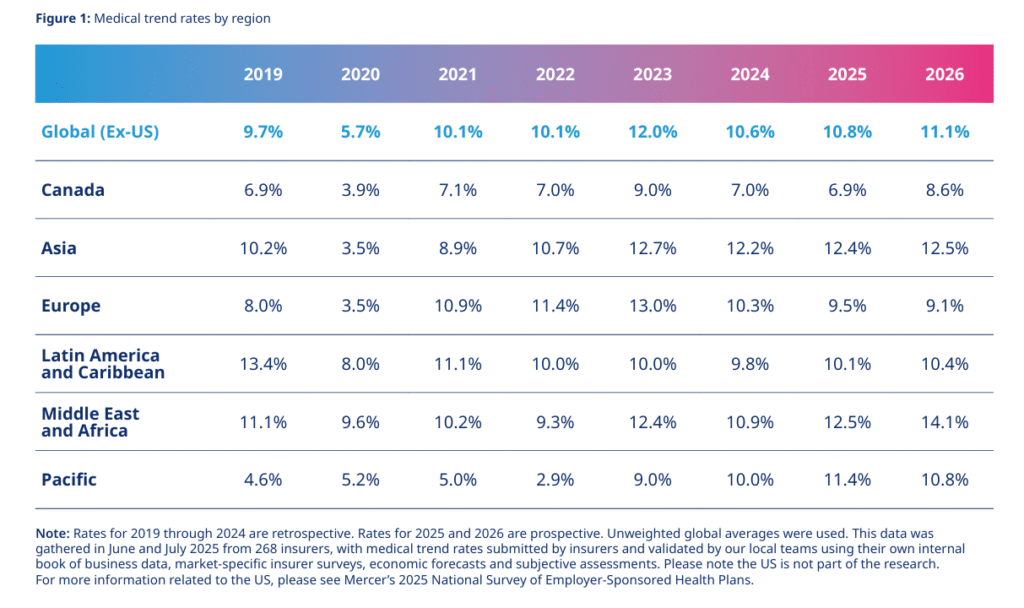

The report indicated an average 11.1% increase globally, up from 10.8% in 2025, with the Middle East and Africa seeing the highest rises up to 14.1% from 12.5%.

Europe was thought to see the smallest rise with its projection of 9.1% down from 9.5%.

The report highlighted that while cancer, diseases of the circulatory system and musculoskeletal conditions continue as the top causes of claims by amount spent, the financial pressures on employer-sponsored health plans, such as inflation and more costly treatments, are intensifying.

But occupational risks, including job demands and exposure to noise and air pollution, are emerging as significant contributors to rising claim costs.

Cutting coverage

The report also points to persistent gaps in benefits coverage, particularly for mental health, reproductive health and support for an aging workforce.

While half of insurers globally include mental health counselling in their plans, only around a third include coverage for mental health medication, and just a quarter typically include mental health screenings within their plans.

Looking to the future, the report found that 76% of insurers were concerned about inefficient and wasteful care driving unaffordability, and many are expecting employers to prioritise cost management initiatives, such as better management of serious claims.

But six in 10 (60%) of insurers polled expect employers to cut coverage to manage costs, with the remainder anticipating organisations to make plan improvements to help address attraction, retention and engagement of staff.

This marks a dramatic turnaround from just three years ago when only 32% of insurers expected employers to cut cover.

‘Reducing coverage to manage costs’

Hervé Balzano, global leader at Mercer Marsh Benefits and president at Mercer Health, said: “For the first time in four years, insurers are anticipating a shift towards employers reducing coverage to manage costs, as opposed to making plan improvements.

“While reducing coverage may deliver employers short-term budget relief, the move can damage the employee experience and their financial security, as well as weaken the company’s ability to attract and retain talent.

“Our experts are working with clients to find opportunities to optimise plans and maintain uninterrupted access to high-quality health care to safeguard employee well-being and address financial challenges.”

Amy Laverock, global advisory leader at Mercer Marsh Benefits, added: “With two-thirds of markets facing double-digit medical trend rates in 2026, organisations must prepare for higher costs and think carefully about how to balance cost management with employee wellness.

“Investing in preventive care and encouraging the use of effective, quality care can address both challenges.”