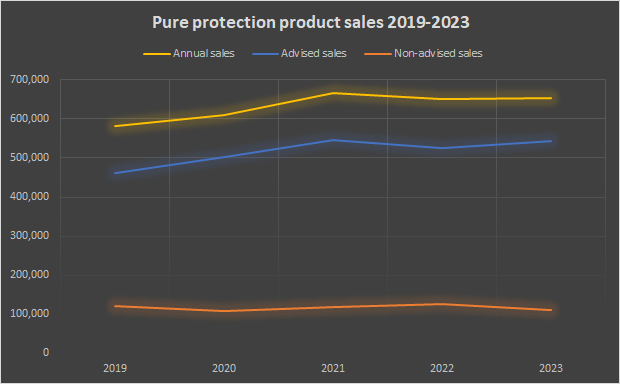

Advised pure protection product sales rose by almost 18% over the last four years while non-advised sales dropped by nearly 9%, with intermediaries increasing their market share to more than 83% of business completed in 2023.

Analysis of Financial Conduct Authority (FCA) figures by Health & Protection shows pure protection product sales surged 12% since 2019 and appear to have plateaued above the pre-pandemic level following a significant post-pandemic uplift.

Encouragingly for intermediaries, advised sales have been responsible for almost all the growth during that time.

However, latest figures from the regulator also highlighted sharp variations across the three product sets sampled with standalone critical illness (CI) and income protection (IP) seeing strong growth, while sales of CI as a rider have declined.

Notably standalone CI sales almost trebled over the period, although this was starting from a much smaller level than the other two products, while IP sales exceeded 200,000 in 2023.

Sales up 12%

Overall, 652,812 pure protection product sales were made in 2023.

This was 72,000 (12%) above the 580,809 completed in 2019 but slightly down from the post-pandemic peak in 2021 of 665,749.

Total sales of the three pure protection products appear to have plateaued at just more than 650,000 per year following surges of 5% in 2020 and 9.2% in 2021.

A drop of 2.1% in 2022 to 651,989 and then a minor increase to 652,812 in 2023 appear to have flattened the market to its current level.

Adviser market dominates

The advised market has been particularly buoyant over the period showing near-continuous growth, as advisers took their market share from 79.4% of CI and IP sales in 2019 to 83.3% in 2023.

Advisers completed 543,694 sales in 2023, up by 82,533 (17.9%) from the 461,161 in 2019.

After growth of 8.8% and 9% in 2020 and 2021 respectively there was a dip of 3.8% in 2022, but this was almost fully recovered last year as advised sales rose by 3.3%.

In contrast, non-advised business has been far more turbulent with a sharp drop last year.

Non-advised sales started the period at 119,648 in 2019 but saw a 9.9% fall in 2020, a 10% recovery in 2021, 6% increase in 2022 and then 13% fall in 2023.

As a result, non-advised completions were down by 10,530 (8.8%) last year compared to 2019.

Critical illness

Sales of CI policies were more than 37,000 higher (up almost 10%) in 2023 compared to 2019, totalling more than 424,000, according to the FCA.

However, this followed two years of falls from the post-pandemic peak in 2021 and sales were down by almost 30,000 (6.5%) from 2022.

Advisers were still largely responsible for growth in the market and upped their share from 75.6% of sales to 78.6% in 2023, but the last year was particularly tough for non-advised sales which fell by a fifth (19.7%).

Overall in 2019 there were 386,636 critical illness policies sold and after two years of 10% year-on-year growth this peaked at 469,230 in 2021, but two slower years dragged the market down to 424,121 last year.

The figures also highlighted that sales of the two critical illness products sampled by the regulator have moved sharply in opposite directions over the last two years, with CI rider sales wholly responsible for the overall drop in completions.

During the period advised sales rose 14% while non-advised sales slipped 3.7%

Rider down, standalone up

CI cover has typically been sold as a rider to life insurance and reflecting that in 2019 there were 362,635 policies sold in this manner.

In contrast, only 24,001 standalone CI policies were sold in 2019 – around 6% of the number of rider policies.

It is also notable that while advisers accounted for more than threequarters of CI rider sales, for standalone CI this figure is around 60%, although adviser influence is growing in this area too.

In 2020 both products saw significant upticks in take-up as a result of the pandemic, with 11,974 more rider policies (3.3%) taken out while standalone sales more than doubled, increasing by 29,942 (125%).

The next year also saw strong increases with rider sales up 9% to break the 400,000 sales barrier and there was 12% growth for standalone plans to surpass the 60,000 mark.

However, their paths diverged in 2022.

Rider sales fell by 24,000 (down almost 6%) and a further drop of 47,123 (more than 12%) last year resulted in sales of 337,476 – down by 25,159 (6.9%) compared to 2019.

In contrast, standalone sales continued growing by 8,466 (14%) in 2022 and a further 17,549 (25%) last year, resulting in 86,645 policies being sold in 2023, which was 62,644 (261%) more than four years before.

The product variations appear to reflect some market dynamics and sales practices, such as increased use of menu style products, but could also account for consumer choices.

Income protection

Income protection sales smashed through the 200,000 barrier in 2023 and product sales have soared almost 18% compared to 2019 with a significant increase generated last year.

In this market advisers are utterly dominant accounting for 87% of sales in 2019 and increasing that to 92% in 2023.

The total of 228,691 IP completions in 2023 was more than 34,000 (17.8%) higher than four years previously, and was more than 30,000 (15.3%) up on 2022.

However this market has also seen ups and downs over the four-year period of the FCA data.

Unlike critical illness product sales there was no pandemic-related surge in 2020 as IP sales dropped by more than 13,000 (6.8%) to 181,054.

This was due to the non-advised market which fell by half in 2020 while advised sales remained unchanged.

There was a notable recovery in 2021 with policy completions rising to 196,519 – up by 15,000 or 8.5%, almost entirely through the advised channel.

The following year saw a slight rise of 1% to 198,294 sales before 2023 triggered significant growth, particularly in the second half of the year with both third and fourth quarters exceeding 60,000 sales each.

During the period advised sales rose almost 25% while non-advised sales slipped by almost 28%