Advisers believe they will be making more protection insurance recommendations as a result of the Consumer Duty, according to research from Guardian.

The insurer also found advisers did not feel introducing the Consumer Duty had been overly demanding and they were generally supportive of provider communications about the incoming regime.

The research showed four in 10 advisers expected to make more protection recommendations with 58% saying they would produce the same number and only a small minority (1%) expecting to make fewer recommendations.

More than eight in 10 advisers (84%) agreed that with Consumer Duty’s emphasis on fair value, portals and associated product analysis services would become a more important part of the selection process.

A similar number (83%) expected Consumer Duty to improve consumer experience of protection, while 81% said it would result in more advisers focusing on quality over price when selling protection.

Advice adaptations

The research also asked advisers about how Consumer Duty was impacting their own businesses, and what changes if any they were making to comply.

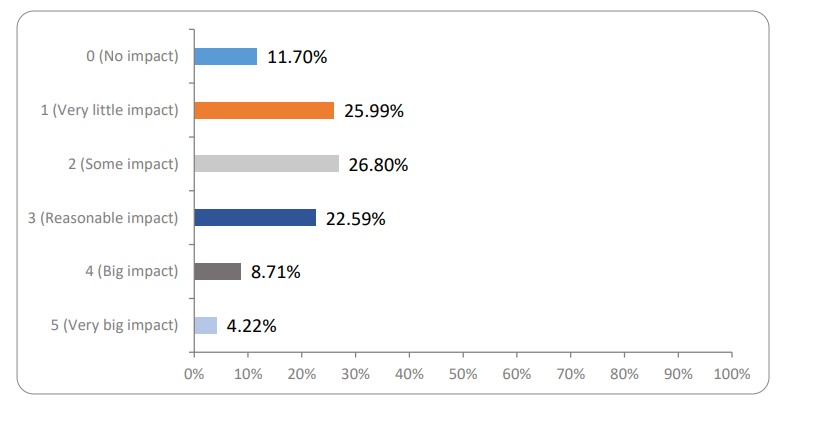

Almost two thirds (62%) of respondents said the Consumer Duty was having at least a degree of impact, with 49% stating it was having some or a reasonable impact, with another 13% stating the impact was big or very big (see chart).

When asked to rank which of the outcomes or cross cutting rules was having the biggest impact in terms of the changes being made to their firm, the 442 advisers who answered this question ranked consumer understanding as number one.

This was followed by price and value, then products and services. Consumer support came next, followed by firms acting in good faith, then firms should avoid foreseeable harm.

Advisers said the requirement for firms to help consumers achieve their financial objectives was causing the least impact, which Guardian suggested most likely reflected that this was already well incorporated into their business and processes.

The survey also asked advisers to rank the area or function within their business that Consumer Duty was causing the bulk of the changes being made.

Of the 429 responding here, advisers ranked advice processes top, followed by client communications and then documenting evidence.

Partnerships, including making protection referrals, was next followed by due diligence of their recommendation, and fees charged, with IT processes being the least affected.

More than a third (35%) of advisers said they would make significant changes to their website, while 89% of advisers said providers’ communication to date was clear and useful enough to equip them to comply with the duty.

Encouraging and positive results

Jacqui Gillies, marketing and proposition director at Guardian (pictured) said: “It’s great to have so many advisers give us their view on Consumer Duty and even better to hear that the regulation is having a positive impact – not just on the customer but on the protection industry as a whole.

“The fact that over 40% of advisers said they expect it to lead to them making more recommendations will mean more customers getting the protection they need.

“It’s also encouraging to know that advisers are taking the duty seriously and making changes to their businesses where they feel they have potential to further improve outcomes for consumers.

“Knowing that 83% of advisers expect the duty to improve the consumer experience of protection is, I think, a massive boost for our industry in the current climate.

“Having carried out our own analysis within Guardian, we appreciate the time and effort needed to be ready for the new regulation coming in at the end of July so it’s good that the vast majority of advisers believe the information from providers is clear and useful – and will allow them to comply with the Duty.”

Roy Mcloughlin, director of strategic partners at Cavendish Ware, said: “Whenever new regulation comes along, the workload and costs associated with the changes are often well documented.

“So it’s really good to see Guardian’s research findings show that when it comes to Consumer Duty, the majority of advice firms agree that it will lead to an improved consumer experience of protection, and also for many, an expectation that they will make more protection recommendations.”