AIG has overhauled its children’s critical illness (CI) coverage by introducing a cut-down core level of cover for children within its Your Life plan.

The changes, as revealed by CIExpert, mean its Core adult policy will have some of the current benefits for children trimmed and will be renamed Core Children’s Cover.

Meanwhile the insurer’s existing children’s cover will apply to the Enhanced Adult policy and will be renamed as Enhanced Children’s Cover.

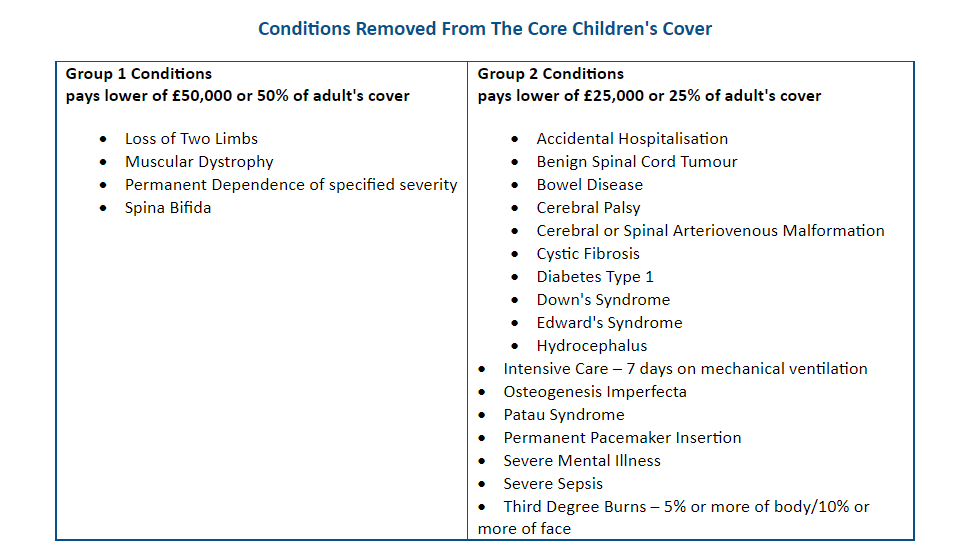

While children’s cover remains optional, the change to the core children’s cover removes the congenital conditions, together with a number of Group 1 conditions and Group 2 conditions.

Birth defect cover is only available within the Enhanced Children’s Cover and benefit payment levels have also been cut for some conditions.

While Group 1 conditions previously paid the lower of £50,000 or 50% of adult’s cover, this has now been reduced to £25,000 or 50% of adult’s cover. Group 2 conditions continue to pay £25,000 or 25% of adult’s cover.

The child death benefit has been reduced to £5,000 from £10,000.

Under the changes AIG has removed four conditions it previously paid £50,000 or 50% of adult’s cover and removed about 17 conditions that pay £25,000 or 25%.

Providing its verdict on the changes, CIExpert said they would bring AIG’s core children’s cover more in line with the standard level of children’s cover in the market that generally do not include congenital conditions.

“Many advisers believe that consumers will increasingly favour cost over quality as their financial burden becomes ever heavier,” CIExpert added.

“CIExpert has always advocated quality over price but the reality is that any cover is better than none, so value-for-money budget plans are likely to become ever more popular. AIG’s move will likely resonate with advisers looking for a value budget offering.

AIG Life has been contacted for comment on the changes and Health & Protection understands the changes as outlined are accurate.