Chancellor Rishi Sunak’s decision not to raise the personal allowance limit and thresholds for Income Tax is expected to earn the government an additional £20bn in the next four years.

Sunak did not mention the policy during his hour-long speech in Parliament which will bring more people and more earnings into tax scope from April.

The Budget documents confirm that the measure maintains the Income Tax personal allowance and basic rate limit at 2021-22 levels from 2022-23 to 2025-26.

This change will have the knock-on effect of maintaining the higher rate threshold, which will also freeze the linked upper earnings limits and upper profits limits for National Insurance Contributions.

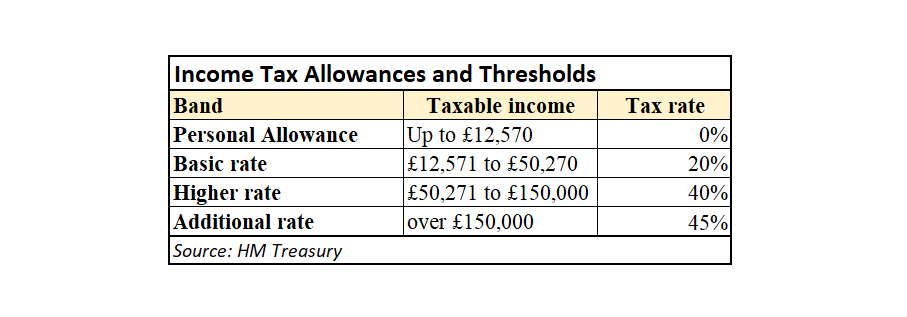

At present the first £12,570 or earnings is not taxed, with anything between this and £50,270 taxed at a rate of 20%. (See chart)

A higher rate of 40% applies above this figure and earnings exceed £150,000 are taxed at 45%.

Overall, Treasury expects to raise an additional £19.2bn over the next four years – £1.5bn in 2022/23, £3.6bn in 23/24, £5.8bn in 24/25 and £8.2bn in 25/25.

A previously announced change to reform income tax basis periods so businesses’ profit or loss for a tax year will be the profit or loss arising in the tax year itself, regardless of its accounting date is also expected to raise around £1.7bn over the same four-year period.