Aviva paid out more than £1.89bn across nearly 62,000 individual and group protection claims in 2024.

Aviva said a total of 61,975 claims were paid across the group’s individual and group protection policies, with more than £5.1m paid out on average every day.

The figures were released today, ahead of the launch of Aviva’s Individual Protection Claims and Wellbeing Report and a Group Protection Claims Report in May.

Following the completion of the AIG Life acquisition last year, Aviva’s protection claims data now includes claims by customers with former AIG Life policies, which have now rebranded to Aviva Protection UK.

Alongside the numbers, the reports provide an insight into Aviva’s claims support and rehabilitation services, how customers use and benefit from added-value services, as well as customers’ individual stories on how their protection policy has supported them.

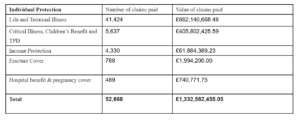

Individual Protection claims paid

And just over £1.3bn was paid out last year on more than 52,000 claims to customers and families with an individual protection policy. A total of 97.1% of all claims received were paid.

Aviva said the significant majority of claims paid were on life policies, including terminal illness benefit. For that 98.8% of claims were paid, with more than 41,000 claims paid totalling just over £862m.

And more than £405m was paid out to customers with critical illness, children’s benefit or total and permanent disability (TPD) claims. Just over 5,600, or 91.5% of all claims received, were paid with an average payment of £71,989.

On individual income protection policies, just over 4,300 claims were accepted last year, receiving benefit totalling more than £61m. A total of 90.1% of all claims received last year were paid.

The average duration of a claim is six years and nine months, with the longest-running claim still in payment in 2024 standing at 39 years.

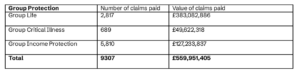

Across all group protection policies, Aviva said more than £559m was paid out to over 9,300 claimants.

Group income protection

Group Income Protection claims that were in payment during the year totalled just over 5,800, with more than £127m in benefits paid out.

The average pay out per claimant was £21,899 and more than 2,600 employees and 290 employers were supported with rehabilitation services. 86% of employees who received rehabilitation support successfully returned to or remained at work.

On Group Critical Illness more than £49 million was paid out to just over 680 customers, with an average pay out of £72,000. Within this, just over £429,000 was paid out to 32 claimants on their policy’s children’s cover.

Just over 2,800 of the claims were on group life policies where lump sums and death in service payments totalled more than £383m. The average pay out was £135,989 and the average speed of pay out was just under three days.

Wellbeing services

Over 680,000 protection customers are registered with Aviva’s wellbeing apps.

The Aviva Digicare+ and Aviva Digicare+ Workplace apps provided by Square Health, and the Aviva Smart Health app provided by Teladoc, continue to help a great number of customers in the detection, management and prevention of health and wellbeing problems.

More than 183,500 customers registered with Aviva Digicare+ and Aviva Digicare+ Workplace in 2024, bringing the total number of registrations since launch in 2020 to more than half a million customers.

With a further 177,000 customers and dependents registered with the Aviva Smart Health app since launch in 2019, this means that more than 680,0004 customers have engaged with valuable wellbeing services such as a Digital GP and mental health and nutrition support.

Claims at the heart

Fran Bruce, managing director of protection at Aviva, said: “Claims are very much at the heart of what we do, with the data from our combined business showing the sheer scale of financial support for customers going through difficult times.

“Although paying claims is the foundation of our business, we know that delivering a great service and having the right support throughout makes a huge difference to our customers.

“The rehabilitation and back-to-work services we provide on our income protection policies are delivering really positive outcomes, our wellbeing apps are hugely valued by customers and their families, while our signposting to partners such as Macmillan Cancer Support, Grief Encounter and Red Apple Law helps many customers manage the daily challenges they face.

“We are investing in data science to further improve our claims processes and we remain steadfast in our mission to deliver valuable protection cover and value-added benefits that ensure our customers and their families are well-supported in every aspect of their lives.”