Chancellor Rachel Reeves is delivering £26bn of tax raising measures by the end of the Parliament in her Budget 2025, much of which is aimed at the better off.

This included maintaining all Income Tax and equivalent National Insurance Contribution thresholds at their current level for three further years from 2028 – a move which is likely to net an additional £8bn.

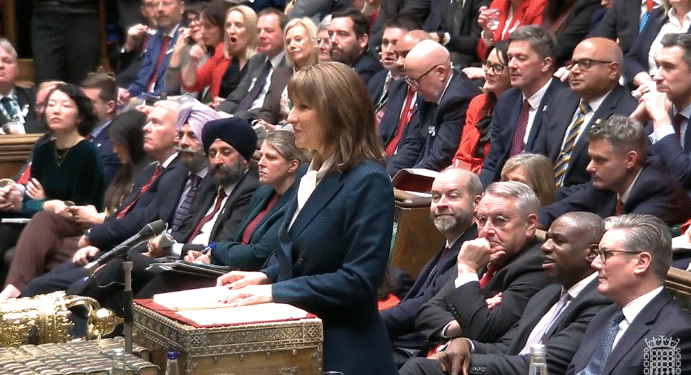

However, one of the highest profile issues of the day was the Office for Budget Responsibility (OBR) publishing its report by mistake before Reeves stood up in the House of Commons – in-effect revealing all the measures set to be announced an hour early.

The body has apologised for the serious error.

As part of the OBR’s Economic and Fiscal Outlook, the body upgraded its growth forecast for the UK for this year, but expected lower results in the following four years.

Touching on the OBR forecasts, Reeves revealed while growth of 1% had been expected this year as of the spring Budget, the OBR has now upgraded this forecast to 1.5%.

However, for 2026, 2027, 2028 and 2029 growth estimates have been cut to around 1.5%, instead of previous figures of around 1.75%.

Overall the OBR reduced its expectations for productivity growth by 0.3 percentage points to 1% by the end of the forecast.

It said: “Real GDP is forecast to grow by 1.5% on average over the forecast period…due to lower underlying productivity growth.”

The OBR added that its productivity forecast will mean £16bn less in tax receipts by 2030.

Reeves’ tax raising measures included a new property tax for properties valued at more than £2m, cutting the cash ISA limit to £12,000 per year for everyone under 65, and cutting the salary sacrifice allowance for pension contributions to £2,000 per year.

However she was able to remove the two-child benefit cap as part of the changes in a bid to reduce child poverty.

Reeves said because of her Budget, “borrowing will fall as a share of GDP in every year of this forecast, our net financial debt will be lower at the end of the forecast than it is today, and I will more than double the headroom against our stability rule to £21.7bn – meeting our stability rule and meeting it a year early.”