Consumers do not typically see a future need for protection and there is confusion and a lack of knowledge about the products and add-on services available.

Research by the Association of Mortgage Intermediaries (AMI) also found fewer than four in 10 consumers recall a conversation about protection with their mortgage broker.

In contrast brokers reported a significant increase in undertaking protection conversations with their customers.

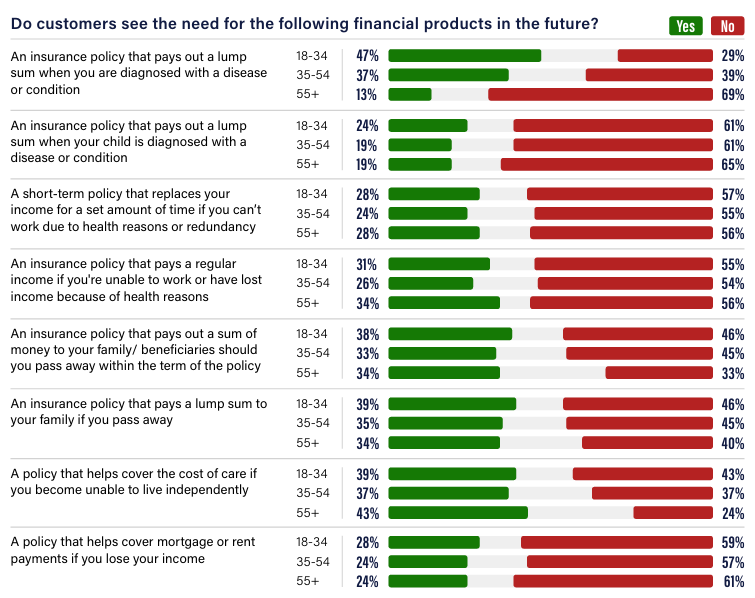

However, the findings that consumers across all three age bands were more likely to not see the need for protection products in the future is most likely to concern the sector.

Typically between just 19% and 39% of consumers recognised a potential future need for protection in a range of circumstances.

Younger adults under-35 were generally slightly more likely to see this need across most types of cover, with critical illness resonating particularly strongly.

For the oldest age group, long-term care insurance was the most pressing need to address.

Across all age ranges cover for children’s diseases and to pay a mortgage or rent upon the loss of income were the least desired.

Adviser conversations

The trade body’s 2025 Protection Viewpoint Report surveyed 3,000 consumers with just 39% reporting their broker had asked about protection insurances.

Conversely, the proportion of advisers who said they advised on protection directly with their customers has increased substantially to 82% in 2025 compared with 66% in 2023.

However, the number of advisers discussing protection at the re-mortgage stage declined from 92% in 2021 to 85% in 2025.

And only half (49%) of mortgage advisers revisited protection when a customer is expecting a child, even though relevant products such as critical illness cover for pregnancy and children could address emerging needs.

In terms of timing, most consumers preferred referrals to happen either during the mortgage process (30%) or right at the start (28%).

Added value services

The report also found client misunderstandings and missed opportunities relating to protection products.

Most consumers did not realise that protection products can come with added value benefits, particularly those aged over 55 (63% unaware of add-ons) and those aged 35 to 54, (56% unaware).

Encouragingly among younger consumers aged 18 to 34 awareness was higher with 44% aware of these sevices but not using them and 7% having used them.

Only 49% said they did not know about add-on services.

Furthermore, nearly a third of young adults (29%) said these benefits made them more likely to purchase protection, with a similar figure for middle-aged adults too (27%).

Only 35% could identify income protection correctly – a slight increase from 31% in 2020, while consumers were found to confuse income protection for accident, sickness and unemployment protection (ASU).