Digitalising distribution channels is the top life insurance trend for 2022, according to Capgemini.

The consultant’s report reveals insurers are increasingly digitalising distribution, channels to provide enhanced convenience and reach (Care).

The report attributes the trend to the impact of Covid on securing new customers, that customers want to interact with brokers when it is convenient, and an exponential increase in the use of smartphones over recent years.

The report provides the examples of Canadian insurer Sun Life which partnered with Google to equip advisers in Asia with Google Workspace to help them communicate more efficiently with clients, automate tasks and work from anywhere.

And it highlighted advisers at UK-based Owl Financial who use the document delivery and e-sign solution AlphaTrust from IPipeline to hold meetings and generate sales while working remotely.

Cloud technology

The report also revealed more life insurers are adopting cloud platforms to gain operational agility.

It said this emerged due to associated costs with maintaining legacy systems, strategic use of data from multiple sources, the need for improved computing capabilities, changing customer expectations and the ability of cloud based solutions to meet life insurers’ regulatory and compliance requirements.

Key examples of the trend include MaxLife in India which is transitioning customer relationship management, workflows and rules engines to the cloud as it transforms investment management and HR systems.

Meanwhile, US-based Principal Financial Group has partnered with Fineos platform to migrate its on-premises claims for group insurance and employee benefits to the cloud.

Other trends highlighted by the report include the shortening of application development cycles becoming a priority to achieve a more agile approach to market, and insurers leveraging alternate data sources and artificial intelligence (AI) technologies to generate customer insight.

Capgemini also noted the promotion of health and wellbeing was becoming far more mainstream for insurers, the inclusion of value added services, and insurers embedding sustainability and environmental, social and governance goals in their strategies.

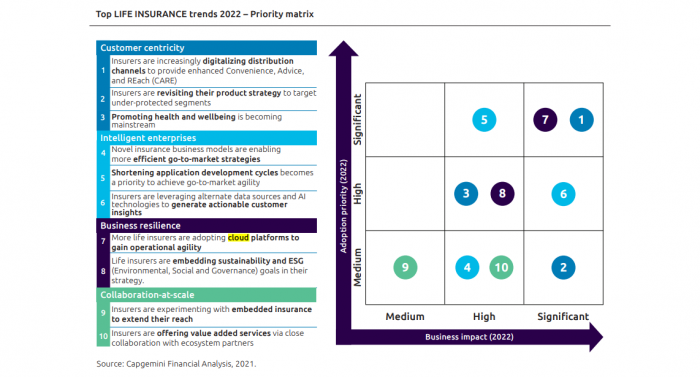

The full list of trends in the report is shown in the graphic below.