The Financial Conduct Authority (FCA) received 10,000 more medical and health insurance complaints in the second half of 2022 compared with the same period of 2021.

The regulator’s data also indicated an increase in complaints across life and critical illness products, but income protection issues fell.

When looking at private medical insurance (PMI) and other health cover, the regulator received 79,351 complaints from July to December 2022, up from 76,789 in the first half of the year and 10,000 more than the 69,749 complaints received in H2 2021.

Across protection cover, the combined whole of life, term assurance and critical illness complaints rose slightly to 24,906 in H2 2022 from 23,689 in H1 2022 and 24,014 in H2 2021.

Income protection (IP) complaints were down on the first half of 2022 and the corresponding period of 2021.

The FCA received 3,192 IP and other accident, sickness and unemployment grievances in the second half of 2022, compared with 3,393 in H1 2022 and 3,216 in H2 2021.

Complaints about other pure protection products returned to a more normal level after a dramatic blip with figures returning to 7,685 from just 840 in H1 2022, though the number of complaints were down year-on-year – from 8,153 in the second half of 2021.

When it comes to protection packaged multi products, the regulator received more than double the number of complaints of the corresponding period of the previous year, up to 827 in H2 2022 from 487 in H1 2022 and just 363 in H2 2021.

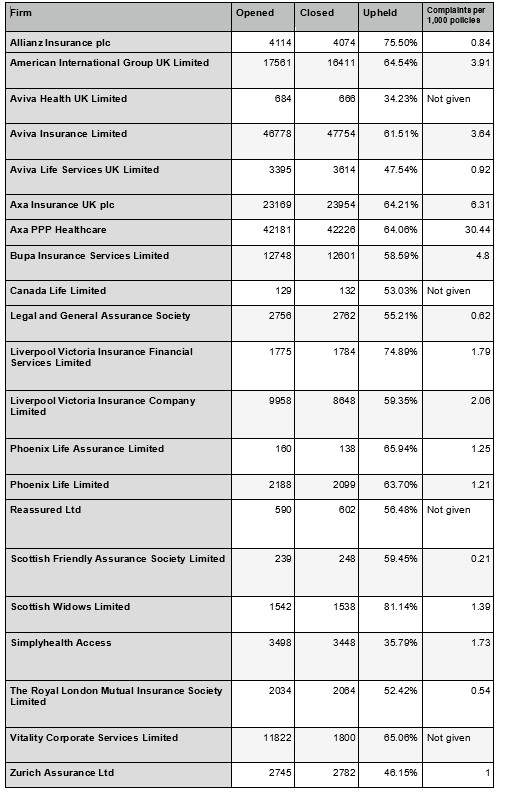

Looking at some of the major health and protection insurance providers (see table below), Scottish Widows saw more than 81% of its insurance and pure protection complaints upheld. Conversely, Aviva Health saw just 34.23% of complaints upheld.

Axa PPP Healthcare posted the highest complaints per 1,000 policies in place (30.44), while Scottish Friendly accounted for the lowest (0.21).

Overall, the FCA received 1.79 million complaints about firms across the financial services sector, a decrease of 6% from 2022 H1.

Home finance product group saw the biggest increase (14%) in complaints received by firms, from 88,514 in 2022 H1 to 101,331 in 2022 H2, the product groups that experienced a decrease in their complaint numbers were banking and credit cards (5%), insurance and pure protection (10%), and investments (10%).