The Financial Ombudsman Service (FOS) has secured up to £22m in redress for consumers who have complained about poor service and outcomes from financial service providers.

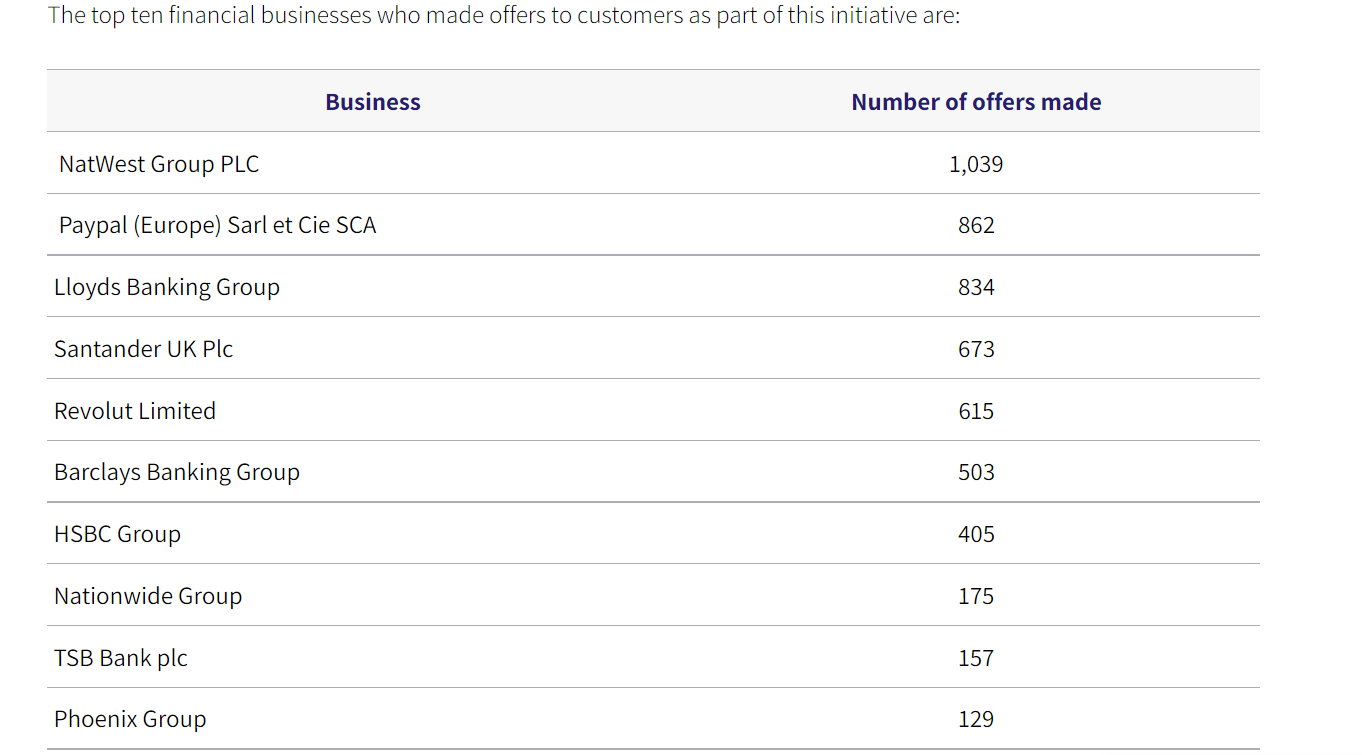

The payments came from proactive work with more than 90 businesses which resulted in 6,877 offers being made to customers and has cut the FOS complaints backlog by two thirds.

Its temporary outcomes initiative launched in November 2021 and was aimed at encouraging businesses to proactively settle complaints quicker.

FOS revealed this more than £10m of redress came from “authorised” scam complaints, with more than 2,000 victims being refunded the money they had lost. The average offer to customers made through the initiative was £3,200 per case.

Alongside the 2,000 fraud cases, FOS revealed the initiative had helped resolve around 4,800 customer complaints about a wide range of issues including e-money services, personal loans, motor finance and credit card purchases.

Nausicaa Delfas, chief executive and chief ombudsman of the Financial Ombudsman Service, said: “We are delighted that many financial businesses have responded to our initiative and have helped customers get their complaints resolved more quickly.

“This was just one of a range of initiatives we put in place to address the large backlog of complaints received during Covid-19. The backlog is now a third of what it was at the beginning of last year.

“We are now moving forward with our Action Plan to change and improve the financial ombudsman for the future.”

The outcome codes initiative started in November 2021 and finished at the end of March 2022.

For a limited period, complaints that were proactively settled by businesses before FOS had issued its opinion did not count towards the business’s uphold rate – the proportion of claims against the business that were successful.