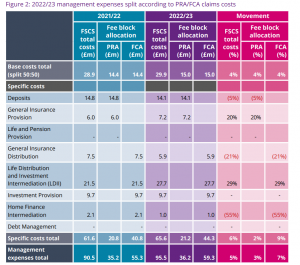

The Financial Services Compensation Scheme (FSCS) is projecting a 21% decrease in the costs of monitoring insurance intermediaries in its latest budget update.

The FSCS revealed it expects the cost of monitoring general insurance distribution, which includes private medical insurance and protection advice, to fall to £5.9m in the financial year 2022/23 from £7.5m in 2021/22.

The FSCS said it expects it will need annual management expenses of £95.5m to run the organisation in the next financial year, up from £85.3min the current 2021/22 year.

However the total levy, including management expenses and compensation costs, for 2022/23 remains forecast at £900m as announced in November.

The Prudential Regulation Authority and Financial Conduct Authority are consulting on an overall management expenses levy limit (MELL) of £110.5m. This includes the FSCS’s management expenses budget of £95.5m and an unlevied reserve of £15m. This contingency fund (£15m) is only invoiced to firms and used if necessary.

The FSCS’s forecast for latest 2021/22 management expenses for the current year now stands at £85.3m – down £5.2m against the budget announced this time last year.

The regulator said it does not expect to use the £15m unlevied reserve it proposed in January 2021 and will not be invoicing firms for this.

It added any budget surplus, which is currently sitting at £5.2m, will be used to offset the 2022/23 levy for financial services firms and will be factored into FSCS’s spring update.

Poor pensions transfer advice

Commenting on the budget update, Caroline Rainbird, chief executive of FSCS, noted the FSCS was witnessing more pension related claims and more individual firm failures associated with multiple financial products which have proven complex to process.

“A key driver behind the expenses we are anticipating for 2022/23 is an ongoing trend in more complex claims with higher processing costs,” she said.

“Of particular note is an increasing number of claims coming through from customers who were given poor advice to move their pensions into unsuitable investments.

“These claims cost us more to process as they have longer handling times and require specialist staff to assess them and calculate the necessary compensation.

“In the financial year to date, we have made over 9,000 requests to firms as part of gathering the supporting evidence needed for these claims. This is an 80% increase on the same time last year and a four-fold increase on 2018/19,” she added.

Rainbird noted that the organisation was doing everything within its power to keep costs down, but the industry also had to step up and understand the situation.

“It is important for the industry to be aware that despite our efforts, the sheer complexity of claims means we will likely see a rise in our management expenses over the coming years,” she added.