The UK group risk market added more than half a million lives covered in 2024 although the rate of expansion slowed due to a more challenging backdrop, according to Swiss Re’s latest annual Group Watch 2025 report.

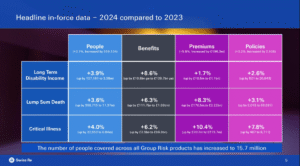

The report shows the overall number of in-force group risk policies increased by 3.2% from 91,739 in 2023 to 94,675 in 2024.

In addition, the number of people insured rose from 15,103,366 to 15,662,500, an increase of more than 550,000 lives or 3.7%.

However, overall sentiment was slightly less positive than in previous years, with many respondents noting the potential for National Insurance Contribution (NIC) increases to impact short-term growth.

Group Watch 2025 drew on the reinsurer’s market data along with engagement with 25 individuals at employee benefit consultants (EBCs), 14 at product providers and three others.

“In the context of group risk benefits, we received a wide range of views as to how employers might meet additional costs,” Swiss Re technical manager for life and health UK and Ireland Ron Wheatcroft said.

“Many respondents expected employers to be reluctant to cut back on group risk products and services, given the positive messages they send to employees and the impact on workplace wellness.

“Others were less optimistic, noting the increasing cost of private medical insurance (PMI) and the fact this could lead to cutbacks on other benefits, particularly long–term disability income (LTDI).”

Swiss Re noted that one unnamed insurer which participated last year had not done so this year, so it’s data for 2023 had been removed when making comparisons.

Death benefits

The number of people insured under group death benefit policies rose to 11,440,262 from 11,040,862 in 2023 – this figure has grown from 9.9 million in 2020.

This latest increase of 3.6% was down slighty from the 3.9% rise in 2023.

Within these numbers, membership of excepted group life policies grew by 9.3%, while registered group llfe policy membership went up by 2.1%.

Wheatcroft said: “There’s a little bit of evidence here that there’s probably some price hardening in the premiums which have gone up a bit faster than benefits and the number of policies has increased as well.”

Group IP

The number of people insured by LTDI, also commonly known as group income protection (GIP), policies increased by more than 127,000 to 3,382,366.

This was a rise of 3.9% compared to 6.6% in 2024.

The number of in-force policies rose by 2.6% to 20,643 from 20,122.

Wheatcroft said: “Overall the disability market is doing well – its obviously got much more scope to grow.”

But he also noted “premiums as an increase are much lower, and that’s to do with some of the changes that we’ve seen in the market.”

Critical illness cover

The number of members insured in critical illness (CI) schemes increased by 4%, down from a 9.6% rise in 2023.

For voluntary and flexible arrangements, growth sat at 5.3%, compared to 6.5% in 2023.

A total of 839,872 people were covered in 2024 up from 807,319 in 2023.

Wheatcroft said critical illness “is a very much used as an employer scheme mostly for people to purchase their own cover through the workplace. We see solid, steady growth there, and that’s been maintained again.”

Slowing growth

Keith Williams, head of group risk UKI at Swiss Re and one of the joint-authors, said: “The fact that all product lines were up in 2024 is hugely encouraging.

“However, following a bumper 2023, growth is most definitely slowing.

“This is partly a consequence of lower inflation driving reduced salary and, therefore, benefit increases.”

One notable theme from the report is employers more commonly insuring shorter benefit payment periods for Group long-term disability (GLTDI).

Major cause for concern

Wheatcroft, also a joint-author, said: “The trend towards shorter maximum benefit payment periods gives major cause for concern, considering the potential impact on the welfare state if an employee is unable to return to work before the end of a policy’s payment period.

“Not only this, as maximum benefit durations get shorter, employees face challenges in contributing to their employer’s scheme due to double taxation of benefits and premiums on voluntary schemes paid through salary sacrifice.

“With employer National Insurance (NI) and other costs going up, abolishing double taxation would go a long way to encouraging more LTDI benefit topping up by workers.

“In addition, it would be great to see tax charges being removed on all trusts where the sole asset is a pure protection policy. We estimate that the costs of administration for employers and trustees for excepted group life policies are at least £4m plus additional legal costs. The tax generated is less than a quarter of that £4m.”

Fitting government thinking

However looking ahead, Wheatcroft had an optimistic outlook for the group risk market with it meeting government workforce demands.

He said: “The market questionnaire showed a positive reaction to the independent review conducted by Sir Charlie Mayfield.

“Despite the short-term challenges employers are facing and cuts in the government’s welfare bill, a greater emphasis on supporting people who are sick or disabled to return to work will undoubtedly position the role of the employer and rehabilitation services at the forefront of solutions.”

And he highlighted that added value benefits were seen as very positive by the market.

“They are well liked, they are well supported and they really came to the fore after the pandemic when people used them,“ Wheatcroft continued.

“And they continue to use them. Which makes it quite difficult to take them away – they are embedded benefits and they are well valued, and they fit very well with some of the government thinking about returning people to work.”