A total of £2.21bn was paid out by the group risk industry during 2022, down marginally from £2.22bn in 2021, according to data from trade body Grid.

Overall there were 261,631 interactions during 2022 with additional help and support services funded by group risk insurers, and 5,651 employees were helped back to work within the same year following a period of sickness absence.

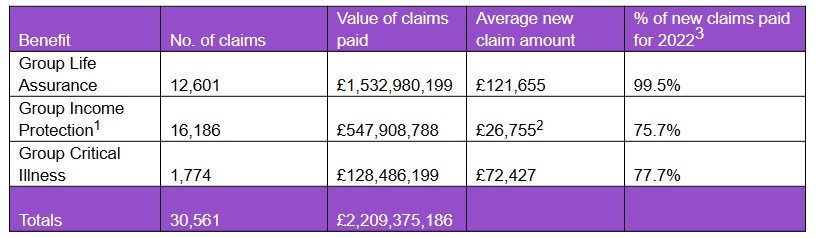

Product data

Group life assurance policies paid out total benefits to the value of £1.53bn – down £36.17m on 2021 – a year in which there were fewer deaths as a result of Covid. The average claim amount was £121,655.

Over the year group income protection (GIP) policies paid out a total of £547.91m – up £1.77m on 2021, with an average claim amount of £26,755 per year.

Group critical illness policies paid out benefits totalling £128.5m – an increase of £22.1m on the previous year. Here the average claim amount was £72,427.

- Total number of claims paid (new and existing) during 2022 and value of claims in payment as of 31 December 2022, including any claims paid for part of 2022. Group income protection claims are often paid for several or many years so the ultimate value of these benefits will be much higher.

- During 2022 there were 6,633 new group income protection claims, totalling £177.47m pa and averaging £26,755 pa.

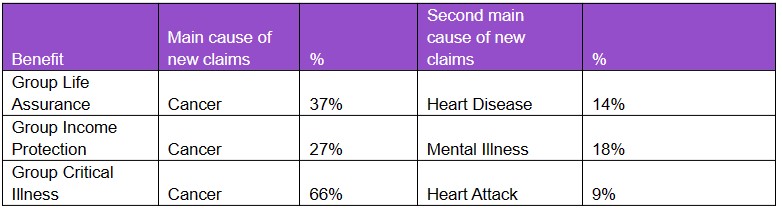

Main causes of claim

Consistent with previous years, cancer was the main cause of claim across all three products during 2022. Covid-19 accounted for 3.7% of group life assurance claims.

Additional help and support

In 2022, there was a total of 261,631 interactions with additional help and support services funded by group risk insurers. Of these, 27% involved access to counselling and 13% were related to illness and 5% to legal issues.

Return to work

A total of 5,651 people took a period of sick leave in 2022 and were helped to return to work within the same year.

Of this group 4,257 people were able to return to work during 2022 due to early intervention; of which, 47% had help to overcome mental illness, and 10% had support overcoming a musculoskeletal condition.

Meanwhile 1,394 people went on to claim a GIP benefit during 2022 and had returned to work within the same year.

A further 1,782 people who became a new group income protection claim in 2021 were helped by insurers to make a full return to work by the end of last year.

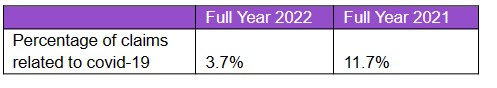

Covid-19 claims

Covid-19 claims for 2022 accounted for 3.7% of group life claims, down when compared to 2021 when Covid-19 accounted for 11.7% of group life claims.

Covid-19 ranked as the seventh main cause of claim in 2022, compared to 2021, when Covid-19 was the fourth main cause of claim for group life.

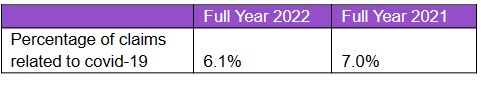

Group income protection

In 2022, Covid-19 accounted for 6.1% of new GIP claims – a decrease compared to 2021 when Covid-19 accounted for 7.0% of new GIP claims.

Covid-19 was the primary cause of claim for GIP in 2022, compared to 2021, when Covid-19 was the fifth main cause of claim for GIP.

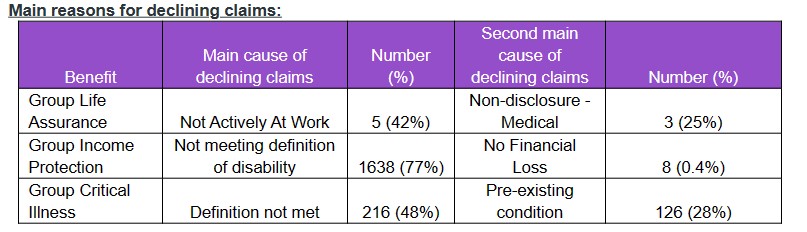

Primary reasons for declining claims

Across product groups, the main reason providers declined group life claims was attributed to the claimant not actively being at work, while for group income protection the main reason was because the employee did not meet the definition of disability under the policy terms.

For group critical illness, the primary reason was the employee’s condition not meeting the definition of critical illness being claimed for.

Katharine Moxham, spokesperson for Grid, (pictured) said: “Once again, our claims stats give a material figure which shows just how much employers and employees gain from group risk benefits: financially, physically and emotionally.

“No other benefits pay out as much, or offer such good value, which is why we’re seeing their popularity grow year on year.”