Guardian has updated two critical illness (CI) definitions and increased its decreasing term intereste rate as its new lower-cost Life Essentials plan goes live.

The launch, revealed earlier in January, means customers now have a choice between the insurer’s existing Life Protection policy and new cheaper Life Essentials plan, with both products available within the insurer’s menu.

At the same time the insurer has made additional changes to its protection menu.

The first is to all decreasing covers, where Guardian is increasing the interest rate from 5% to 8%.

This more closely aligns to mortgage interest rate levels and the rates at which clients will typically be seeing their outstanding mortgage decrease. Alongside, it is removing the mortgage guarantee.

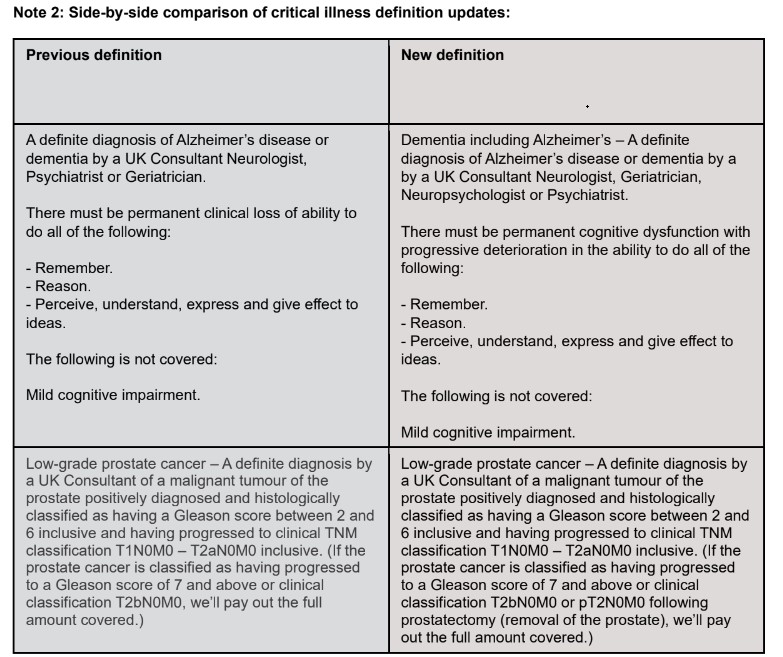

In addition, in line with the Association of British Insurer’s (ABI) latest review of critical illness minimum standards, Guardian has altered two of its critical illness definitions: dementia and low-grade prostate cancer.

Hilary Banks, sales director at Guardian, said: “We’re delighted to announce that our new Life Essentials cover is now available for quote and apply within our platform, Protection Builder, as well as on Iress, IPipeline, Protection Platform from UnderwriteMe, and LifeQuote.

“We’ve also been encouraged by the comments about the role of advice in explaining quality differences, as this choice is ultimately about providing fair value to different customer segments and continuing to drive good outcomes and build trust in our industry.

“Going forward, we’re very excited to begin working with our advice partners to maximise this important distribution opportunity and get more people the protection they need.”