The UK’s health, wealth and happiness levels are plumbing depths not seen since the height of the pandemic, according LifeSearch research.

The advice firm’s Health, Wealth & Happiness Index found almost a third of the UK population reported a deterioration of their mental health when compared to last year.

It noted higher durations of leisurely screen time and a cost of living crisis were only intensifying these health and wellbeing issues.

Happiness at rock bottom

The combined Health, Wealth and Happiness Index – compiled by the Centre for Economics and Business Research (Cebr) for LifeSearch – fell 11% over the last year dipping close to record lows witnessed at the height of the Covid pandemic in 2020.

The research found that a quarter of people were less happy today compared to a year ago, while 32% of Brits said their mental health and wellbeing had worsened in the last 12 months.

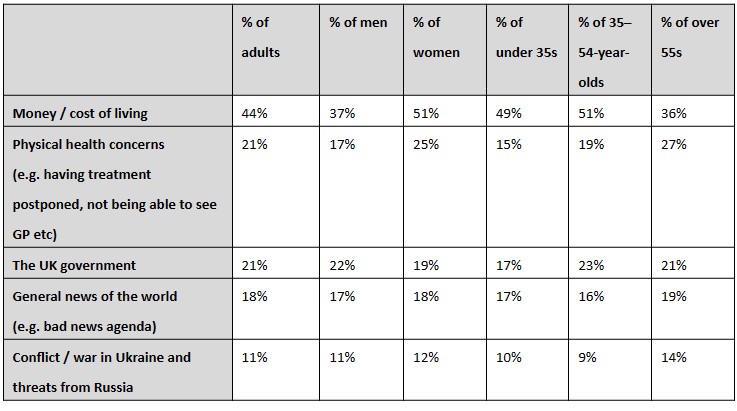

More than half of respondents felt worse off than a year ago, while the research showed the rising cost-of-living was the main driver of poor mental health for 44% of Brits, rising to 51% of women.

Impact of increased screen time

The study also found that respondents who had a lot of screen time were far less happy overall and were almost twice as likely to report poorer mental health.

On average, Brits spent 28 hours a week on a screen (excluding work and school or education), averaging four hours a day, while almost one in 10 spent more than six hours a day on a screen on workdays (8%) and weekends (9%).

Just 4% of adults spend less than an hour on a screen per week for leisure.

Two-fifths (41%) of those that had the most screen time on weekdays (six hours or more) reported their mental health had worsened in the last year, compared to just 30% of those that spent less than two hours a day on a screen.

Around a third (32%) of those that have the most screen time each weekday (six hours or more) said they were less happy today vs the same time last year, compared to 23% of those that spent less than two hours a day on a screen.

Emma Walker, chief growth officer at LifeSearch, said: “After the record lows we saw in the Health, Wealth and Happiness Index at the height of the pandemic, we experienced some optimism last year when we saw some green shoots of recovery as the index rebounded.

“But that was short-lived as the cost-of-living crisis has dragged the index back down close to pandemic levels again.

“It may then be no surprise to find Brits’ wealth experienced the biggest falls in the last year, but our health has also dropped, including our mental health which has worsened for one in three of us in the last year.

“This is then culminated by the revelation that our happiness today has fallen to its lowest point in over a decade.”

Walker added it was worrying to see the number of hours Brits on average spent on a screen for leisure – totalling 28 hours a week for the average person.

This was on top of the screen time potentially required for work or school in any given week.

“We are seeing a correlation between high screen time usage and poor mental health along with general levels of unhappiness,” Walker continued.

“Given that having strong relationships is the key to happiness for the majority of Brits, maybe it’s time to cut down the screen time and invest time in tangible connections with friends and family.”

Worries about being worse off

Turning to wealth, in the last 12 months, the Wealth Index fell by a further 15%, indicating lower values than during the pandemic.

In Q3 2022, the cost-of-living crisis ensured this index fell to a near record low in the series, before a partial recovery in the last six months led by stock market growth, continued labour market stability and improving household perceptions.

However, respondents expect to be £233 worse off each on average per month due to inflation, rising to £264 per month among men, £366 per month among the under 35s and £546 per month among Londoners.

Three in 10 (30%), rising to 35% of women, said money and the cost-of-living were likely to have the biggest negative impact on their mental health in the year ahead.

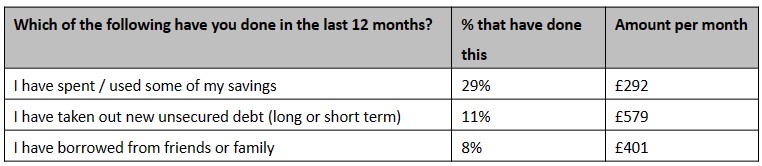

The data has also revealed that 29% of respondents had to raid their savings over the past year to cover rising living costs, depleting their rainy-day funds of £292 on average every month, totalling £3,506 a year.

One in 12 (8%) respondents had to ask their families for money – £401 a month on average, while one in eight were forced to take on more debt, either short (8%) or long term (4%), borrowing £579 on average.

Coping strategies

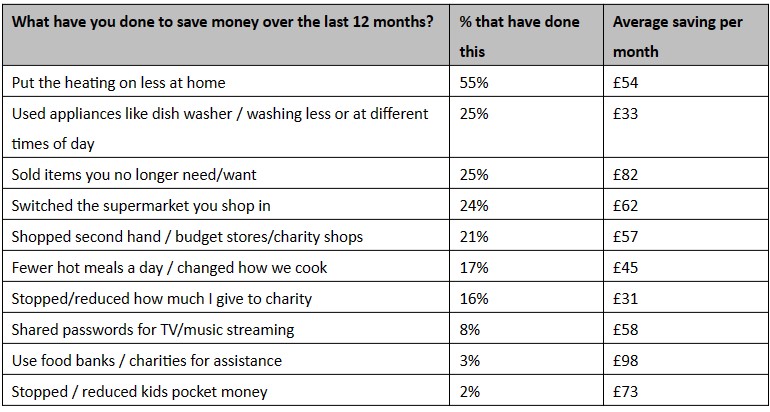

To try and cut costs, the majority (55%) of respondents reported putting the heating on less.

One in four (25%) were trying to use household appliances less frequently, a further one in four (24%) had switched supermarkets to make savings, while one in five (21%) had shopped in second hand shops and budget stores.

One in thirteen (8%) said they shared passwords for music and TV streaming, rising to 13% of under 35s, saving them £58 and £74 respectively each month.

However, one in six (17%) people admitted they had cut down on the number of hot meals they were having or changed the way they cook, to save around £45 a month.

Worryingly, one in 30 (3%) were saving just under £98 a month by using food banks with a similar number (2%) stopped pocket money for children, saving around £73 a month.

Charity donations were also cut back by 16% overall and by 20% of the over 55s.

Nina Skero, chief executive of the Centre for Economics and Business Research (CEBR) added: “The latest edition of the Health, Wealth and Happiness Index shows that 2022/23 was a tough period for households.

“We expect pressures to persist in the coming year, especially in terms of inflation and spending power.

“Nevertheless, the outlook is somewhat rosier than was the case at the turn of the year, with consumers showing considerable resilience in the face of troublesome economic conditions.

“This provides some hope that the depths of 2022/23 will not be repeated and that the index’s components can return to improvement.”