High medical inflation is the biggest driver of benefits costs across the world and many employers are planning to renegotiate insurance contracts, according to Aon’s 2025 Global Benefits Trends Study.

The study found cost management was the top strategic priority in 2025 for all multinationals organisations, regardless of region, industry and company size.

Seven in 10 companies cited this as their first strategic priority.

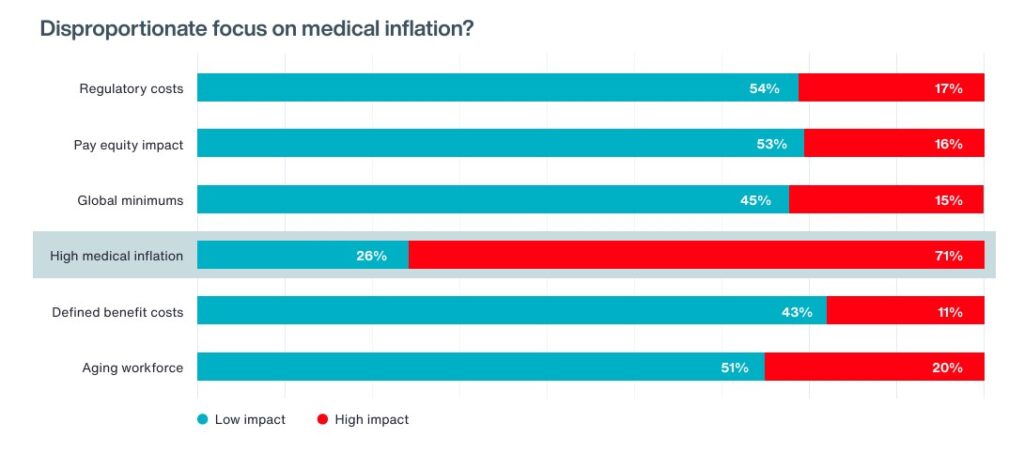

The survey of 518 global benefits professionals across Europe, the Middle East and Africa (EMEA), Asia Pacific (APAC), the United Kingdom (UK) and North and South America (Americas), found high medical inflation was the primary driver of benefit costs.

Again seven in 10 (70%) respondents said it had a “high” impact, compared with 20% who expected an aging workforce and 17% anticipating the regulatory burden to have high impacts on benefit costs.

While APAC and EMEA headquartered companies also viewed medical inflation as the biggest cost driver to manage, participants from these regions appeared to take a more balanced view of the drivers of this medical trend, putting more weight on the impact of aging, pay equity legislation and regulatory changes.

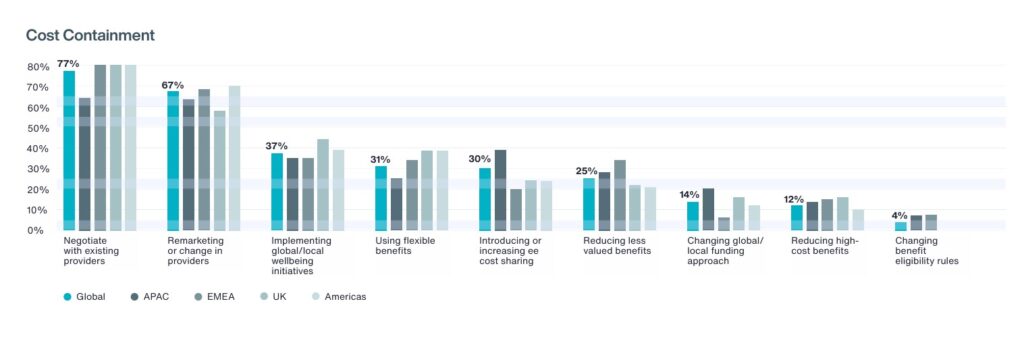

Strategies to mitigate costs remain basic and short-term in view, Aon noted, where respondents were found to be focusing primarily on hard negotiations with insurance carriers and other vendors.

More than three quarters (77%) planned to negotiate with existing vendors, and 67% planned to go to a request for proposal (RFP).

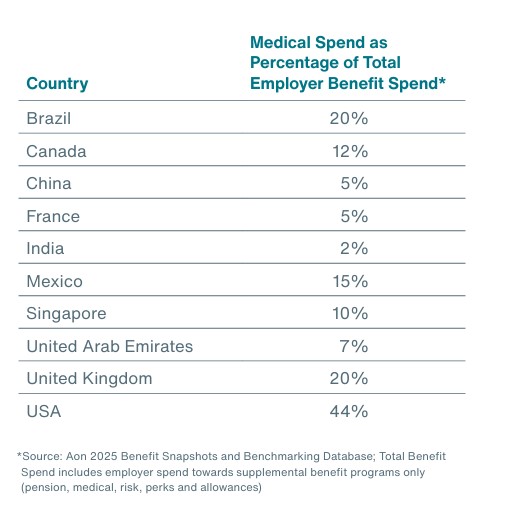

The report also found that depending on the country, medical costs could represent anywhere from 2% to 44% of total employer spend on benefits.