The individual private medical insurance (PMI) market is growing exponentially.

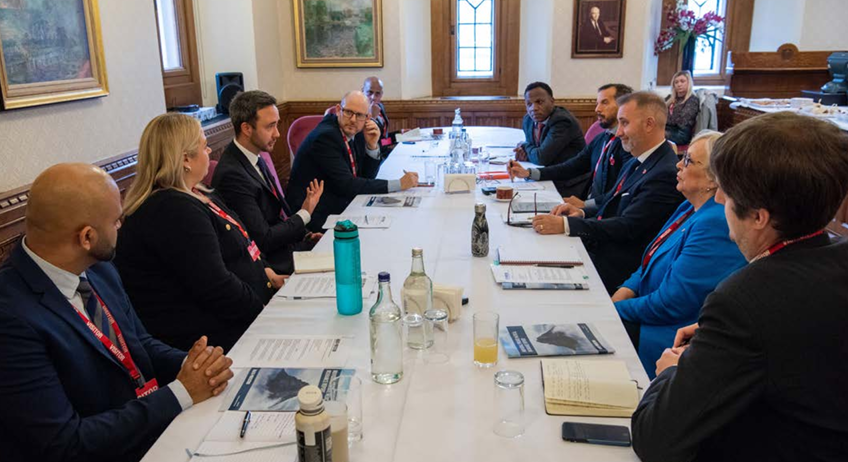

This is not just down to effective marketing of the product, but also to market forces, extensive press headlines and ongoing record NHS wait times, according to advisers who gathered at the House of Lords for Health & Protection’s individual PMI roundtable.

However, PMI is not cheap, so guided options where insurers choose the consultants that customers can see are increasingly coming into their own as a way of mitigating these costs.

And advisers were clear that their role has perhaps never been more important in ensuring customers know exactly what they are signing up to.

Fear driving people to hang onto cover

“I think people are more interested in actually investing in their health now,” Marcia Reid, non-executive director at Sherwood Healthcare, said.

“And clearly it was driven by the concerns about the NHS. So I would imagine the growth will continue.”

Reid added older people were keen to maintain cover. “From my experience of where I work, what we see is that the older generation are keeping their membership going.

“Whereas historically people get to a point where the premiums are so expensive they put the money in a fund instead, but I think fear is driving people to hang onto it.”

Doubling in two years

But advisers made clear the focus for insurers was on adding as well as retaining customers.

Ian Sawyer, commercial director at Howden Life & Health, said his firm had seen “significant” growth over the last two years.

“It’s almost 100% growth in two years,” Sawyer said.

“That’s not all down to market demand. That is about different things that we do and also the advertising strategies of our partners.

“One of the areas where we’ve seen interesting growth in is child-only. That’s become around 12 to 14% of our sales now; that’s interesting.”

And Sawyer agreed with Reid’s assessment of market demographics.

“That’s why the flexibility within the products in terms of excess options and guided options are so important so that there are metrics and mechanics to keep on top of the premium increases,” he added.

Sunny Solanki, director of Usay Compare, echoed Sawyer’s sentiments on the growth of the market.

“Since 2021 we’ve seen exponential growth in PMI policies sold. Again, it’s not all down to what we’re doing.

“A lot of it is market forces, media headlines and the NHS challenges. Tying this in with where we are looking for younger people to join the market, there is evidence to suggest this customer group has grown.

“And we are finding insurers suggesting that there are now slightly younger demographics looking into private healthcare, not hugely, but that group is growing.”

Explaining guided options fully

Against this backdrop of market growth and ongoing cost of living challenges, guided options are coming into their own.

For Peter Lurie, managing director of ProActive Medical & Life, the key to these options is explaining them fully and making sure that the client understands exactly what is meant by “guided”.

Lurie noted he has had cases where his advisers could not have explained what this means any more than they had, but the client was still confused over what a guided option actually involved.

“We’ve had cases where we’ve explained it and couldn’t explain it more than we have done, and they still have a problem,” Lurie explained.

“I had one client this week who said he wanted to really look at upping all that,” Lurie revealed.

“But now the problem is that the insurer won’t allow him to increase the hospitals on his list because he’s got a pending operation.

“Even if it’s on the NHS, they still won’t allow them to up their hospitals – which I also think is a little bit strange from the insurer’s perspective. In this case he can’t have cover for that because it was a pre-existing condition.

“He knows he’s getting all his treatment on the NHS. He’s still on a guided option. He still wants to increase his hospital list. But the insurers are saying ‘no because you’ve got something planned with the NHS we’re not going to allow you to increase it’.

“It doesn’t help the client and it could potentially help the insurer.”

Where insurers appear inflexible over guided options, client relationships are key Alex Mhandu, head of healthcare at Alan Boswell Group, noted.

He supported the guided option, but said: “It’s about us educating them.

“You need to let them know what they are signing up for.

“We’re talking about PMI being expensive because it is – but there’s certainly a huge place for it, especially in the current climate.”

Location, location, location

Mhandu also maintained that location of the business is a key factor. “A lot of it is also down to location as well,” Mhandu said.

“We’re Norwich-based in a Norfolk farming community.

“We’ve got some really good hospitals there. Guided options have been so good for our clients because of the choice, the consultants and the hospitals in our area.

“It works a treat. It lowers the cost. When policies become unsustainable, it’s the best solution.

“You find that it’s almost a no-brainer for a lot of these clients in our area just because you’re going to use the same consultant, the same facilities. So it’s a good solution.”

Kim Powell, partnership manager at ActiveQuote, said 90% of the firm’s new business is now guided options.

“We actually default our panel because it’s price comparison,” Powell said.

“So when a customer sees the quotes they automatically see guided options.

“It just works. You’ve got a customer that’s going through that price comparison journey and it’s price driven. All of ours are defaulted that way at the moment.”

Communication is key

Customer complaints was also a hot topic raised by advisers, with Powell pointing out confusion around guided options is a key factor behind these grievances.

“It definitely caused a rise in complaints for us,” Powell explained.

“They do make up quite a large amount of our complaints.

“But it’s all down to the understanding as well. We put in quite a lot of measures in place in terms of discrepancies, making sure certain things are mentioned.

“So it’s getting the advisers to step away from putting any kind of indication as to what exactly is going to happen, just to say the insurer is going to select those for you.

“It’s a tricky one to manage, but we’ve definitely seen the complaints come back down again. Initially there was quite a lot.”

Leather or plastic seats

For Sawyer, customers need to understand that guided options are a compromise. “Customers need to understand what the compromise is,” Sawyer explained.

“You’re accepting a discounted premium for a restriction in your choice.

“So the way we label it is either your choice or insurer choice.”

While Reid interjected that this choice could be a case of whether customers want leather or plastic seats, Sawyer rejected that analogy.

“They’re all leather seats,” Sawyer said.

“But you’ve got three to choose from and they’re all comfy leather seats.”

Consultants changing contracts

Though even when the choice is clearly explained, this can all be scuppered by a consultant changing their contract as Lurie pointed out.

He revealed he had a case involving a customer who had read all the fine print and thanks to a guided option with a buyback secured a 50% discount on his premium with his insurer.

“The only issue was he had a pending specialist operation which he needed with a specialist surgeon,” Lurie said.

“And at first the insurer said no because he had this pending operation to go to guided option, but then they allowed him to do it,” Lurie said.

“The problem came in when he actually needed to claim on that. They then turned around and said this consultant’s not on the guided list, but we’d made sure that he was.

“Eventually they came around and they said we will cover him because this is so specialist, and he was one of the only surgeons who could do this operation.

“So the customer managed to get it covered and was really happy in the end with that outcome.

“But the fight that we had to put in for that hadn’t been a such a good point.

“It did work in this case, but had it been another insurer who was not as in tune with the market as his provider, we could have potentially had a big problem.”

Download the roundtable supplement for the discussion by following this link