Government’s increase to employer’s National Insurance contributions is not likely to affect demand for private medical insurance (PMI) as waits for NHS treatment stay stubbornly high.

But there is more chance of the sector’s professionals having pet unicorns than government cutting insurance premium tax (IPT) any time soon.

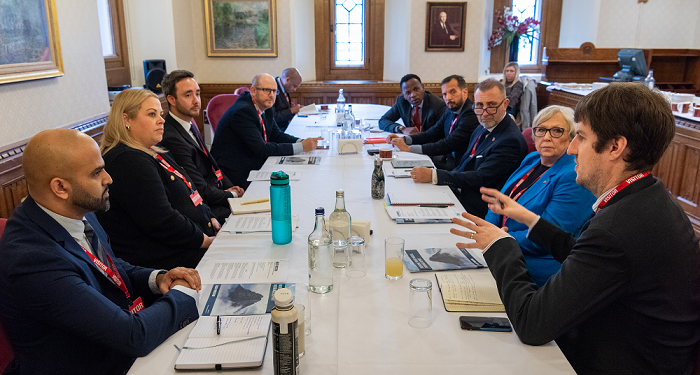

This was the conclusion of advisers gathered gathered for Health & Protection‘s latest House of Lords individual private medical insurance roundtable.

Rate rise

Delivering her first Budget speech earlier this week, chancellor, Rachel Reeves, announced the the rate of employer’s National Insurance would rise by 1.2 percentage points to 15% from April 2025.

The scheduled increase raised immediate fears among advisers that that the move could see firms reduce or cut staff benefits like health and group risk all together.

But advisers gathered in the Houses of Parliament for Health & Protection‘s latest Lords roundtable disagreed.

Marcia Reid, non-executive director at Sherwood Healthcare, maintained the increase would have more of an impact on employee pay rises.

Alex Mhandu, head of healthcare at Alan Boswell Group, agreed adding one of the key selling points of group PMI, particularly for SMEs, remains that it is a business expense and it is company funded.

“I think on that point, we’re still going to see growth,” Mhandu said.

“With the NHS, the wait list is still 7.6 million people. I think it will still help that.”

Improving the NHS

But key to the success of government’s plans will be how it uses funds collected from its increased tax take on improving the NHS, Peter Lurie, managing director at ProActive Medical & Life, said.

“Because prevention is better than a cure – and that’s what the NHS really needs to focus on,” Lurie continued.

“And I think the biggest issue for consultants specifically in the NHS is this constant demand to deal with acute issues rather than preventative issues.

“And if there is a shift change in that over the next 10-20 years, then we’ll see a dramatic effect on private medical in a positive manner.

“So prices are still going to go up with insurance with the way NHS is being run right now and because of the cost of medicine.

“But if the NHS had a big shift change as the biggest employer in the country, that could make a huge difference to us.”

Lurie added NHS management also needs to change to deliver an improved service.

“Hopefully you’ll have some clear heads thinking about how to do this, but when you’re employing people who are not medically trained to do the job of running the NHS, it doesn’t help your cause,” he said.

Whole of workforce versus management perk

A further factor is whether employers choose a whole of workforce solution or reserve group PMI for management, Sunny Solanki, director at Usay Compare, said.

“Is it just for management?” Solanki continued. ” Is it just for the employee level? Or do the people who need it more actually not have access to it? Because that then brings about a whole different issue – does it affect pay rises for instance?

“If you remove PMI as a company benefit and they can’t then afford PMI because the pay rise isn’t matching inflation etc, where do you go?

“Because the employee then does not have a corporate policy and they’re not going to be able to afford an individual policy – what is the outcome for them?”

Potent recruitment tool

Mhandu suggested that in these instances, group PMI comes into its own as a recruitment tool.

“I think that’s where there is potential with the SME market because another selling point for companies is they could say, ‘We can’t give you a pay rise, but we’re putting in the benefits’ and I think it’s happening already.

“There is a lot of instances where employers say, ‘We don’t pay as much as Joe Bloggs Ltd down the road but look at what we offer.’

“And even with the NI contributions and all of those overheads, group PMI is still more favourable.”

Difficult to remove

Ian Sawyer, commercial director at Howden Life & Health, agreed, adding he did not think the market will lose schemes overall because it is very difficult to remove a scheme for employees once it is in place.

“There are different levers you can call on upon for employers for instance, such as at what point you enter the scheme,” Sawyer added.

“So there is a scheme where once you hit a year or two years you qualify for the scheme and so forth.

“So I don’t think we’ll be losing schemes, but I think the employers NI will impact on pay rises next year.”

Pet unicorns

While there was relief in the room that Reeves did not put insurance premium tax up, advisers gathered were not confident this will not happen in future.

“I see this one as one of two in terms of Budgets,” Solanki said. “It was a soft entry for us, but it was an Autumn Budget – so it was part one of two.

“I don’t know if Reeves will increase IPT, but it wouldn’t be a huge surprise.

“There’s a responsibility on this government to facilitate the growth of PMI to remove that burden that the NHS carries at the moment,” Solanki continued.

“Yes people are still using the NHS, but for those planned operations people go private and we hope that unburdens the NHS.”

And on the likelihood of the IPT being reduced, Reid said: “It’s a political hot potato.”

“But the Tories wouldn’t do it. I think we’ll get pet unicorns first.”