A shortfall in technical skills and a retiring workforce is proving a key pain point for health and protection insurers and their technology systems, writes Owain Thomas.

Download the roundtable supplement for the discussion by following this link.

Recruiting competent and skilled people can be a challenge for any organisation but when the basic tools for the job are evolving so rapidly it can prove even more difficult.

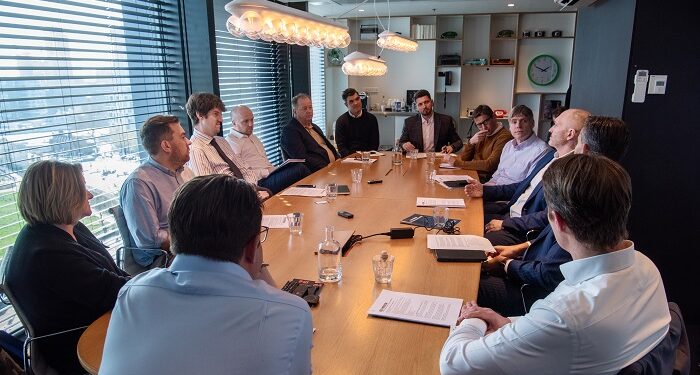

Attendees at the Health & Protection technology roundtable in association with Comarch reported how significant this problem was within their parts of the insurance industry.

It is particularly difficult where insurers are operating with systems which do not use more modern programming languages.

As Scottish Widows lead solutions architect Calum Thorburn explained those challenges can be felt quite acutely.

“We have problems with our systems where the skills to maintain these systems are no longer taught in universities,” he said.

“So the people who built these systems are now rolling off to retirement and the cost to acquire resources becomes much more expensive.

“There’s regulatory requirements and just common sense, all of these things, that you need to maintain those systems, so you enter this race against the clock before your staff retire, before you even get on the system.”

This was not a unique position with several delegates highlighting the difficulties in getting skilled people in the right positions.

‘A dying breed’

Cirencester Friendly director of technology John Underwood recognised there could be differing views of what a legacy system was, and age of technology was not necessarily a deciding factor.

And that can have major implications for hiring people and finding skills.

“The business will have a view of what the legacy system is but when you recruit a load of new developers they think dot net is legacy,” he said.

“So I recruit people and they ask, ‘what’s this legacy system?’

“But I tell them it’s in support, it’s perfectly valid, there’s nothing wrong with it and to leave it alone, because they want to recode it in all new modern languages that they’re familiar with.

“So that’s touching the point that people aren’t learning some of the older technology.”

Underwood added that the system he inherited was around before he was born, so it was quite an easy decision for the organisation to leave that particular platform.

“But yes, that is a bit of a challenge from a resourcing perspective,” he continued.

“Trying to find people that have got the experience of operating things like dot net now who are new to the market and affordable, because they’ve becoming a dying breed.”

If there is a silver lining to this situation it was that it created a strong argument for investment in technology teams and the wider operation.

As Unum chief information and digital officer Lio Lopez-Welsch explained: “Hopefully these are the business cases to actually get the systems replaced, when you’ve got those very powerful arguments and compelling arguments and are having to ask for funding.”

However, he jokingly noted there could also be drawbacks to having the skills to maintain older technologies.

“The problem I have is that I did COBOL when I first started in my career many years ago,” he said.

“So when I told my boss that some of these systems had got very old technologies that I used to use back in the 90s or whenever, the feedback I got was, ‘you can support them then’.”

Incentivising staff

Another issue raised was that of managing and activating skills from the workforce already present within organisations.

Mobilising individuals into reskilling and upskilling but still protecting legacy systems and getting buy-in from stakeholders, all while still meeting ongoing product needs, was seen as a key challenge that insurers were tackling.

However, for WPA chief technical information officer Mike Downing, there was a more pragmatic and iterative approach to maintaining the insurer’s systems.

“We’ve been lucky because we’ve got three generations of technology but they’re all the same flavour and we have a six-weekly feature release,” he said.

“So for the last 20 years, we’ve been building out and modernising that feature set, so that gradually drags the older technology up to the same level.

“We also then run modernisation projects just to target certain areas of the system where something’s looking a little bit dated.

“We’ll tackle that and we almost put this as a challenge to the staff that if they update this legacy element they get to look after the modernised version, so it’s a bit of an incentive.”

Meeting the business roadmap

But legacy systems are not a cut-and-dried definition.

There is also risk and expertise requirements attached to newer systems as well which should be factored into organisational plans.

As WTW head of technology consulting UK&I Algirdas Dineika explained, legacy can be seen as a spectrum from real legacy green screen into the modern legacy.

“You have a good platform, but actually is it?” he said.

“You don’t know if the business roadmap will be supported in 10 years or so, then you get into the integrated environment and then the ecosystem.

“So where’s the legacy? Is it the real legacy, the green screen, or the modern legacy?

“And the skill set deficit is on both sides of the spectrum – for legacy I find it hard to find skills and for a really modern one it is also hard to find because there are so many skills people need to know across the stack that it’s almost impossible for one person to know,” he added.

Bradley Jones, insurance – business development manager at Comarch, agreed that modern legacy systems were a reality that needed to be understood.

“Of course COBOL is 100% a legacy system, its 80 years old, but we’ve seen systems that are five years old, even four years old and be a legacy,” he said.

“From our perspective, the legacy system is one that cannot adapt to the client requirements or cannot become client centric or cannot adapt to a shift in growth aspirations of the insurer.”

Download the roundtable supplement for the discussion by following this link.