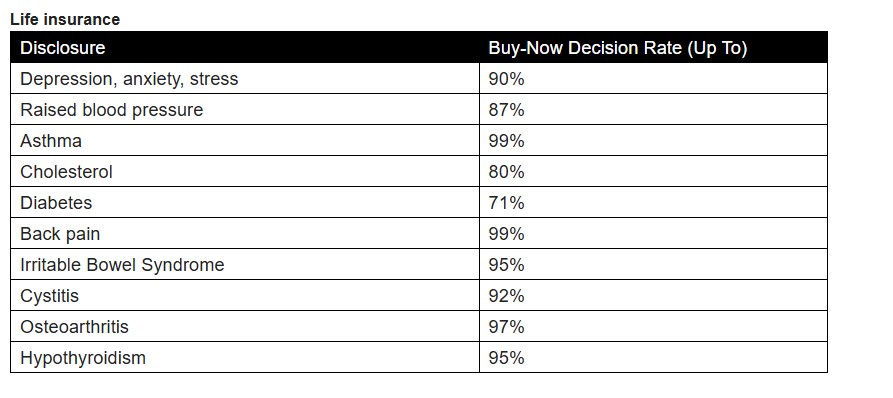

Almost all life cover applications with asthma, back pain and osteoarthritis disclosures were instantly accepted by insurers in 2024.

The findings, taken from UnderwriteMe’s Protection Platform Pulse Report 2024, showed that life decisions ranged from 99% for asthma, back pain (99%) and osteoarthritis (97%) at the higher end, compared to 80% and 71% where cholesterol and diabetes were disclosed.

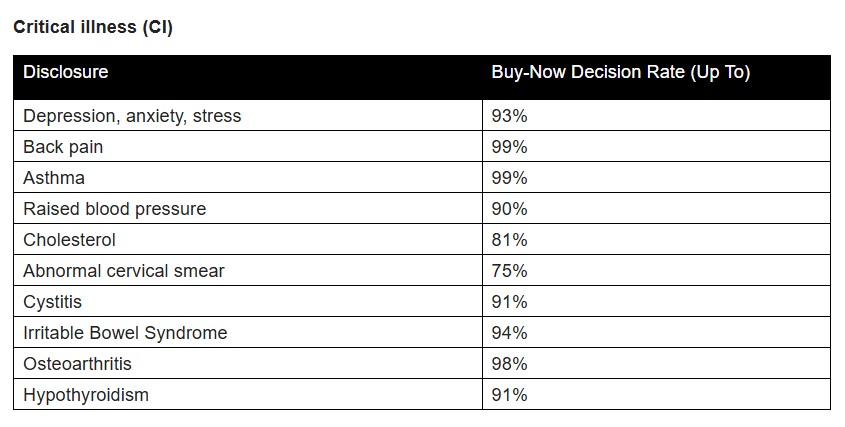

For critical illness cover, asthma and back pain (both 99%) and osteoarthritis (98%) were also at the higher end when it came to decisions, with cholesterol (81%) and abnormal cervical smear (75%) at the lower end.

Further findings from the report show that there are an average of 1.16 disclosures per customer. The data suggests that a number of applicants disclose existing health conditions or lifestyle factors that require underwriting consideration.

Furthermore, the demand for bundled protection was found to be rising with an average of 1.4 products per application.

Straight-through processing

The report analysed straight-through processing rates, which showed life cover stands at 85% and critical illness (CI) at 80% for all applications.

It said the rising trend in life cover and life with CI submissions signals a growing demand for comprehensive coverage solutions.

Straight through processing for income protection (IP) remains at an average 62% (2023 and 2024).

UnderwriteMe partners with a number of insurers including HSBC Life, LV=, Royal London, Scottish Widows and Vitality. The anonymised and aggregated data is taken from applications submitted and purchased on the platform across all providers throughout 2024.

Andrew Doran, CEO of UnderwriteMe (pictured), said: “The Protection Platform continues to offer highly competitive straight through processing (STP) rates year-on-year, with life cover at 85% and life cover with critical illness (CI) at 80%, indicating a competitive market where underwriting efficiency is key.

“The slight rising trend in life cover and life with CI submissions signals growing demand for comprehensive coverage solutions.

“Additionally, STP for income protection (IP) remain at an average 62%, which is due to IP underwriting being more complex than life cover products.

“While the volume of placed applications is important, STP rates remain a key measure of efficiency, and a deeper understanding of disclosure trends can drive better outcomes for both advisers and customers.

“In a highly competitive market, where clients expect speed and convenience, high STP rates provide advisers with a significant advantage — streamlining the buying process, improving client satisfaction, and ultimately driving more business growth.”

‘Buy now’ decisions

Looking at ‘buy now’ decision rates, depression, anxiety and stress made up the most common health conditions that receive instant acceptance across life insurance, critical illness (CI) and income protection (IP) applications.

Tom Conner, strategy development director at Drewberry, said: “Protection advisers know that when a case is referred to underwriting the process can often be long – sometimes many months, which is time consuming and costly.

“In some situations clients lose interest during the underwriting process and contacting them with a higher premium once they’ve lost interest can be a lost cause.

“Protection is not at the top of most peoples’ minds so when they do contact us, we need to be able to deliver solutions as quickly as possible.

“Systems that provide ‘buy-now’ functionality is essential for protection advisers where cases have certain underwriting issues and it’s great to see so many non-standard applications being accepted.”

Doran added: “Over the past year, the life and protection insurance industry has gone through significant shifts.

“From provider mergers to rising living costs, evolving customer expectations, and increasing regulations, it’s becoming increasingly challenging for advisers to navigate a rapidly changing landscape.

“However, the findings in our Protection Platform Pulse Report are a positive sign and highlight not just UnderwriteMe’s strengths but the industry’s move toward more inclusive underwriting.”

Britney Trussler, protection manager at Dynamo, added: “The most common disclosures we encounter include high blood pressure, high cholesterol, diabetes, and mental health conditions and we frequently see a high rate of instant decisions from UnderwriteMe, provided recent medical readings are within normal or slightly elevated ranges.

“This is a significant advantage for advisers who help clients with underwriting issues as we can offer provide cover in the same time frame as those with a clean bill of health. Instant decisions for clients with pre-existing conditions significantly reduce the time advisers spend seeking indications from multiple providers, offering immediate reassurance and greater efficiency.”