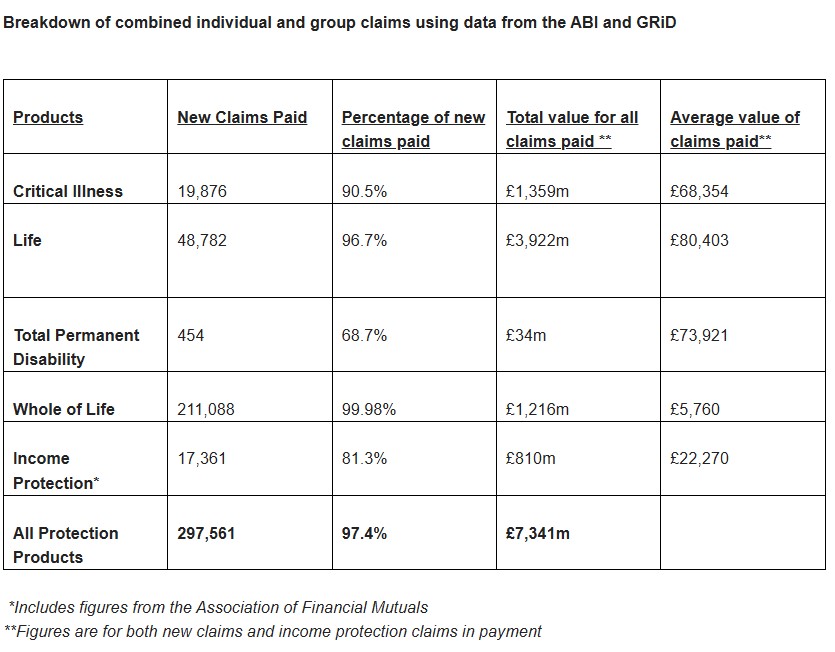

Insurers paid out a combined record of £7.34bn in protection claims last year, according to figures from the Association of British Insurers (ABI) and Group Risk Development (Grid).

According to the analysis, individual policies paid out more than 275,000 life insurance, income protection and critical illness claims, totalling £4.85bn.

This represented a 5% increase in the number of individual claims paid and a 14% increase in the total value of claims paid compared to 2022.

In May, Grid said the UK group risk industry paid out a record £2.49bn in claims in 2023, with £1.69bn paid out across group life, £633.6m across group income protection and £160.3m across group critical illness.

Critical illness

Turning to individual protection claims, the total value of individual critical illness claims increased to record £1.2bn last year.

This figure reflected an increase of £136m – up 13% when compared to 2022 data. The number of critical illness claims also increased by 10% from 2022, with the average claim for 2023 at £67,267.

Continuing on from recent years, cancer remained the most common cause for these claims, totalling £777m.

Income protection

Total pay out for individual income protection claims hit £177m.

This was up £3m (2%) compared to 2022, bringing the average claim pay out up to £9,425.

This was in spite of a drop in the number of individual income protection claims in 2023. During the Covid-19 pandemic, there was a rise in the number of individual income protection claims, and the figures have gradually dropped since 2021.

Musculoskeletal issues such as neck and back pain were the main cause for an individual income protection claim in 2023, though mental illness claims accounted for the highest value at £37m.

As of 2023, more than 1,660 individual income protection claims have been in payment over 10 years, with 376 of those claims in payment for more than 20 years.

High claims acceptance rates

Claims acceptance remained high at 98.3%

The number of new individual claims paid remained consistent above 98%. The average claim paid rose by 9% to £17,053 compared to £15,643 in 2022.

The most common reasons for declined claims were policyholders failing to disclose existing medical conditions when they took out the policy, and not meeting the policy definitions.

Yvonne Braun, director of policy, long term savings, health and protection at the ABI, said: “Every single day in 2023, the protection insurance industry paid out over £20m to individuals and families affected by serious accidents, illnesses or even the deaths of loved ones.

“The financial impact of these events can be devastating, adding even more stress to traumatic situations.

“These figures demonstrate that insurance plays a crucial role in supporting people financially when they need it most.”