Adviser Robyn Allen has called on insurers to advertise income protection (IP) directly to consumers.

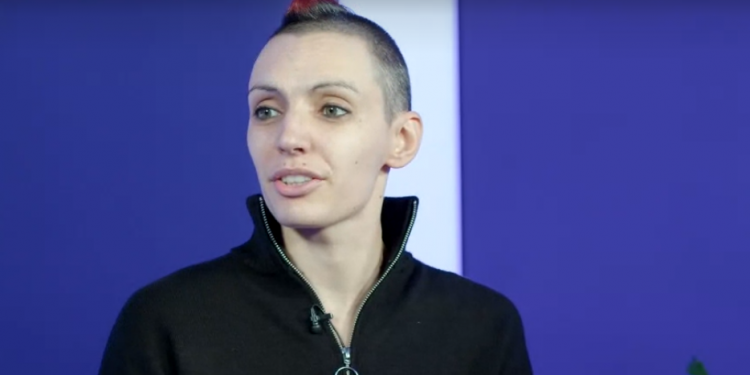

Allen, the owner of Robyn Allen Solutions, (pictured) who was taking part in a panel debate on the final day of Income Protection Awareness Week, said it was important the whole industry did a better job communicating the idea of IP.

“Within the adviser community [we need] to have these conversations with people but also within the insurer world, because they all need to be on the same page and communicating in the same way,” she said.

“So maybe we can start to see some direct to consumer advertising for income protection from the insurers and not just from the IPTF.”

Allen added that the sector also needed to do more to eliminate jargon.

“Offline this morning I had an acronym thrown at me that my brain just didn’t engage with straight away and I’m an adviser in this industry,” she continued.

“So, I do think there is a lot more work to be done and a lot more conversations to be had around that, because we create literature that explains these terms are different with a lot of insurers and consistent language is incredibly important.”

Confusion with PPI

Fellow panellist Rhys Schofield, managing director at Peak Money, agreed and highlighted the industry need to do more to shift the perception that income protection ispayment protection insurance (PPI).

He revealed that when asking what people thought about income protection, most consumers did not have a positive word to say about it, with most thinking it was PPI or recalling a negative experience where someone had tried to sell them IP.

“It’s a completely different product,” Schofield said.

“It’s there to protect an income – not a thing which is a bolt-on for a credit card that you’ve just rung up to activate or something like that.

“It’s there to protect the most fundamentally important part of making sure the wheels keep turning financially which is protecting your income, especially when we’re in a time where the public perception of other insurance is that they seem to prioritise these things more.”

Scholfied cited the example of vet insurance.

“I don’t know how many office dogs we’ve got at Peak,” Schofield continued.

“But we worked out how much everybody is paying and it’s well over £1,000 a month to pay off vet insurance between the team at the moment.

“We’re probably not spending that much on income protection among the team and then the fact more people insure their phones more than their income as well.”

Consequently, Schofield concluded by saying the industry needed to overturn the idea in the public’s mindset that IP is less important than life and critical illness cover.