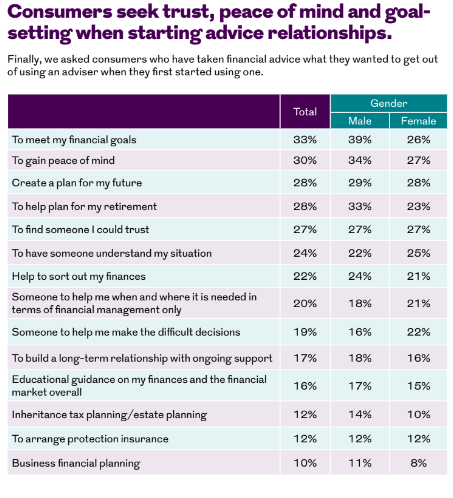

Just 12% of consumers wanted to arrange protection insurance when they first engaged an adviser, according to research from Royal London.

The study also found adviser expertise and insight were more highly valued for income protection (IP) and critical illness (CI) than for life insurance which was more commoditised.

The insurer’s 2025 Meaning of Value research examined consumer value judgements across a range of financial services products and incorporates financial adviser perspectives to understand both consumer and adviser views on value for money.

Opinium quizzed 2,000 UK adults for their views while The Lang Cat surveyed 1,300 advisers to give their insight.

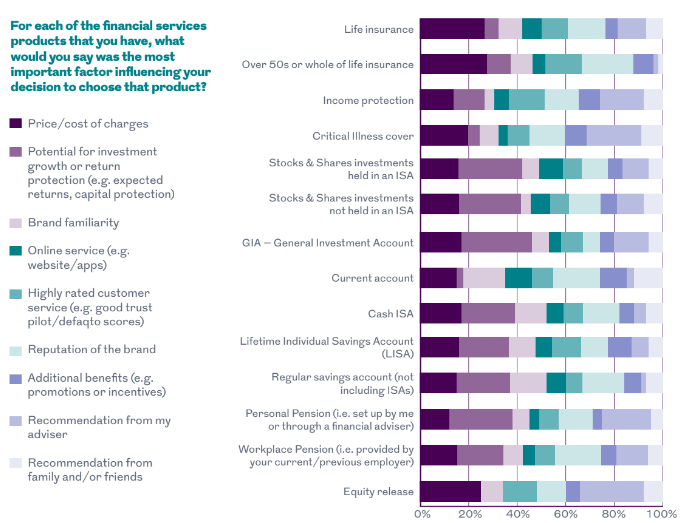

Initially, the research found price was a key determining factor in whether to buy certain protection products like life insurance, but less so for CI and IP.

In contrast for these products recommendations from an adviser were more highly prized, along with additional benefits and services and higher customer service ratings.

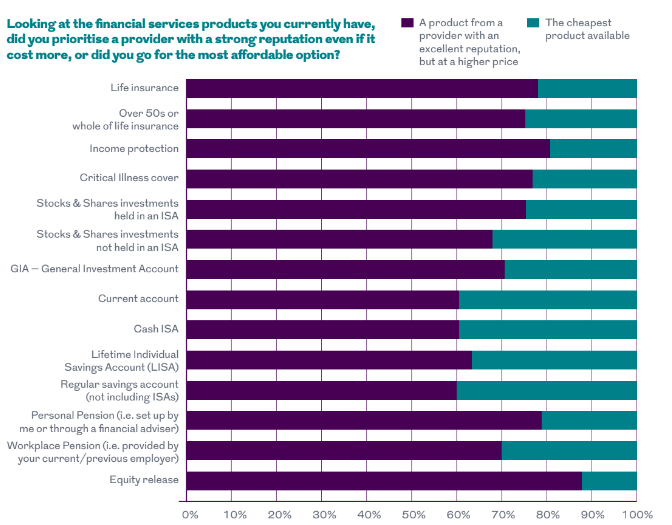

Furthermore, across protection products the reputation of the provider was far more important than price, with only personal pensions and equity release rated more highly in this regard.

It was notable that among the consumers surveyed, only 12% had directly sought out advice to buy a protection product.

However, the top two reasons were to meet their financial goals (33%) and to gain peace of mind (30%), followed by wanting to create a plan for their future (28%).

Quality of service

In its third year, the report revealed that, more than ever, people are seeking not only help in meeting their financial goals but also peace of mind and expert guidance for later life planning.

Overall, the key findings indicated that when working with an adviser, consumers highly valued support in achieving their financial objectives, reassurance, and assistance in developing a robust financial plan.

When it came to choosing financial services products, the top priorities were quality of service, trustworthiness, and competitive pricing.

The report also highlighted a continued rise in the perceived value of financial advice, with 68% of consumers who pay for advice rating it as good or excellent value for money, up from 53% three years ago.