One year after the introduction of the Financial Conduct Authority’s (FCA) Consumer Duty, the complexity of financial documents including for private medical insurance (PMI) has barely improved.

And PMI itself has shown no improvement at all, according to consumer group and ratings provider Fairer Finance.

Consumer Duty states that firms should communicate with customers not only in a way that is ‘clear, fair and not misleading’ but also to equip them with the information needed to make effective and informed decisions.

But Fairer Finance’s analysis of the readability of financial terms and conditions and policy documents shows that reading ages, use of jargon, and word length have barely improved across key financial products in the past year.

PMI ranks poorly

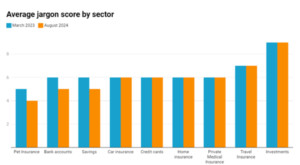

Fairer Finance developed a jargon score to analyse the legal, industry, and everyday jargon in financial documents across nine sectors, including PMI.

In terms of complexity of language, PMI financial documents showed no improvement, and ranked alongside car insurance, credit cards and home insurance.

The simplest financial documents were for pet insurance, followed by bank accounts and savings, each of which had improved over the last year.

The PMI sector did better than the travel insurance and investments sectors – neither of which had shown any improvement over the year either.

Fairer Finance notes that 7.1 million people are deemed “functionally illiterate,” yet reading ages for financial products range from 15 to 18 years old.

Fairer Finance discovered that investment and car insurance terms and conditions require the highest reading age, averaging 17.5 years.

Savings accounts and pet insurance have the lowest average reading age at 15.5 years.

However, there is much inconsistency within sectors; for example, credit card providers’ reading age ranges from 11 years to over 20 years.

Very poor literacy skills

Fairer Finance said: “Despite the onset of Consumer Duty, average reading ages have changed little in the last 12 months which suggests most firms haven’t yet substantially re-written their terms or policy wordings.

“The National Literacy Trust reports that 16.4% of adults in England (7.1 million people) have ‘very poor literacy skills’ classifying them as ‘functionally illiterate’ as reading information from unfamiliar sources or on unfamiliar topics could cause them problems.

“These consumers with poor literacy skills are also deemed ‘vulnerable’ by the FCA.

“Furthermore, the government estimates that one in seven adults in England (14.9%) have the literacy skills expected of a nine to 11-year-old.”

Fairer Finance added: “As with reading ages, jargon scores have had minimal movement in the last year, although pet insurance, bank accounts, and savings terms do seem to be moving in the right direction.

“Investment terms and conditions remain the most difficult to understand.”

Tough conversations ahead

James Daley, managing director at Fairer Finance, said: “It’s disappointing that more than a year after the Consumer Duty came into force, we’ve barely seen any improvement in the clarity of financial terms and conditions.

“The new FCA rules are very clear that firms must be able to prove that their customers can understand the information they are given,” Daley said.

“However, the reading ages, length and complexity of most terms and conditions are well above the level that most people will find easy to engage with.

“We know that some firms are busy addressing these issues. But others are taking the view that no one reads the terms and conditions so there’s no need to act.

“We expect that these firms will be having some tough conversations with the regulator over the months ahead.

“We know from experience that it’s absolutely possible to create terms and conditions that are clear and simple for customers to understand – while still meeting the requirements of legal and compliance teams.

“Terms and conditions are used by customers as manuals – which is why it’s crucial they are well organised and make it easy for people to find the information they are looking for. When they get there, they shouldn’t need a legal degree to be able to understand it.”