Life and health insurers should develop products to cover under-represented groups, promote “fair and inclusive underwriting” and offer mental health services as an essential benefit, according to a dedicated United Nations (UN) department.

The global body also urged insurers to promote healthy lifestyles through incentives and to support education to improve insurance literacy.

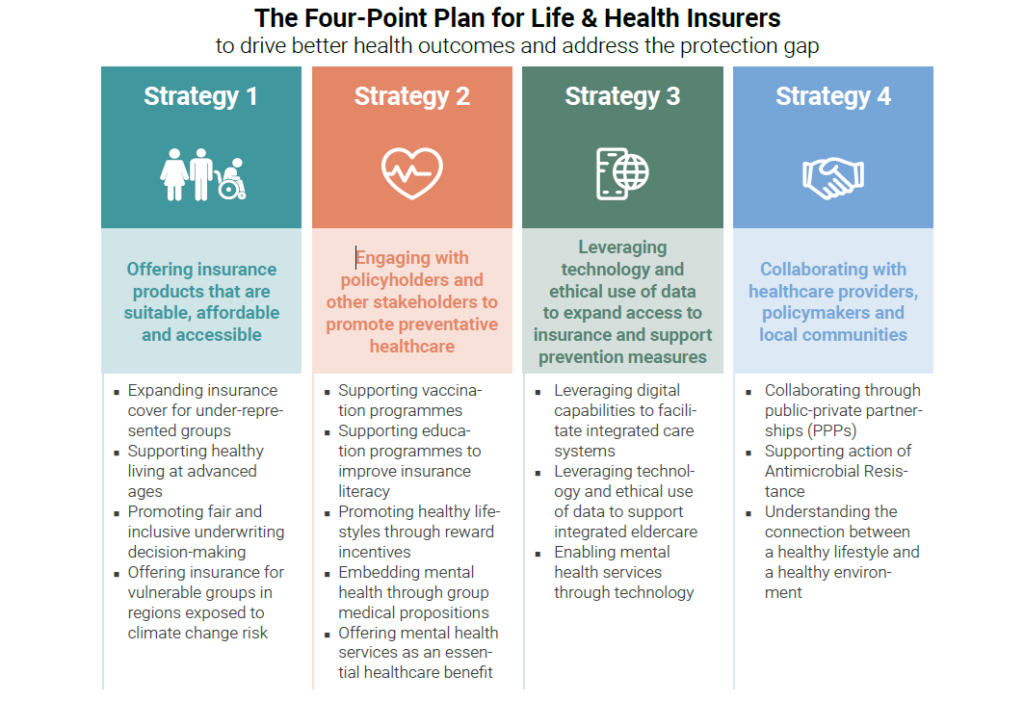

The recommendations are part of a plan published by the UN Environment Programme’s Principles for Sustainable Insurance (PSI) initiative for insurers to follow to address the protection gap and drive better health outcomes.

It consists of four overarching strategies with 15 underlying actions and best practices to improve global health outcomes. The four strategies are:

- Offering insurance products that are suitable, affordable and accessible

- Engaging with policyholders and other stakeholders to promote preventative healthcare

- Leveraging technology and ethical use of data to expand access to insurance and support prevention measures

- Collaborating with healthcare providers, policymakers and local communities

“This plan suggests that life and health insurers can incentivise a preventative healthcare model, expand access and affordability of life and health insurance products, and promote healthier lifestyles in multiple ways, while also capitalising on the potential business prospects from expanded services and products,” the UNEP said.

It added that the suggested strategies are interdependent, particularly in the case of technology and data, which can be leveraged for the implementation of the other strategies.

The Health is our greatest wealth: How life & health insurers can drive better health outcomes and address the protection gap” report has been developed by the Principles for Sustainable Insurance Initiative’s Life and Health Working Group.

The report noted that access to inclusive, high-quality healthcare greatly enhances the ability to live a healthy life but there were increasing obstacles to this, particularly for disadvantaged people.

“In a post-Covid world increasingly impacted by climate change, nature loss, social inequality and the cost-of-living crisis, the global health protection gap has continued to grow, especially for those from vulnerable groups,” it said.

“Furthermore, determinants of health, such as a patient’s education, lifestyle and environment, are underestimated when providing care.”

Some of the 15 key objective raised by the report are:

Promoting fair and inclusive underwriting decision-making

The report gave a pair of examples where insurers had worked to increase availability of products for HIV-positive customers, where it said adjustments in underwriting philosophy had vastly improved the protection customer experience. Key considerations include:

◾ Ethically leverage artificial intelligence and machine learning to provide underwriters with new insights for customers with long-term health impairment

◾ Tailor underwriting to the individual and provide personalised ratings, ensuring the circumstances of the individual customer are considered

◾ Explore a broader range of medical factors and attempt to simplify the underwriting process

◾ Focus on inclusive product design to help narrow the existing shortfall for those customers with long-term health impairment

Expanding insurance cover for underrepresented groups

The report noted that around the world, large numbers of vulnerable groups such as rural populations, women, low-income individuals and those with a disability or chronic disease, lack access to life and health coverage, especially in emerging markets.

By implementing strategies, like offering digital health services or providing microinsurance, insurers can help increase access for these groups.

Extending coverage to these groups will help address inequity, ultimately improving global access to healthcare and protecting a larger portion of the global population from the financial implications of ill health.

Promoting healthy lifestyles through reward incentives

The report highlighted how insurers can move beyond single interventions by offering behavioural platforms centred on rewards, personalised goals and changing daily lifestyle habits to improve overall wellbeing.

These models allow for higher engagement and a more proactive relationship with the customer, illustrative of how life and health insurance can move away from solely reimbursing damages towards facilitating a more preventative healthcare model globally.

Offering mental health services as an essential healthcare benefit

The report found that more insurers including tailored mental health support as part of their health insurance plans.

It said this was necessary not only to protect and promote mental wellbeing but also to cater to the diverse requirements of individuals with mental health conditions.