There was a slight increase in protection and health insurance coverage in the two-year period since the pandemic first, hit fuelled by growing appetite for health cash plans and income protection.

However most of the UK population continued to lack protection cover of any kind, according to the Financial Conduct Authority (FCA).

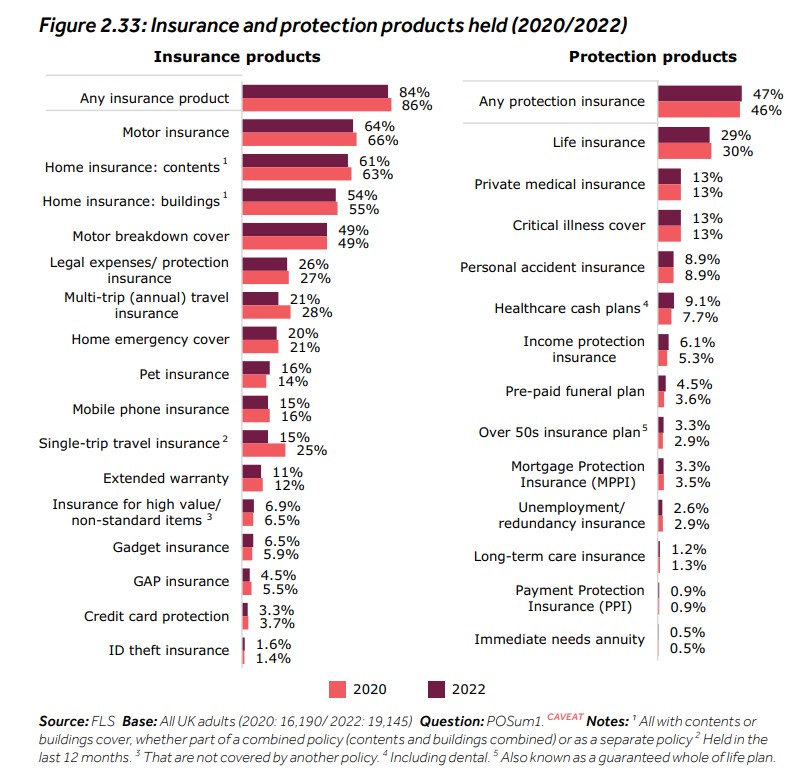

The regulator’s Financial Lives Survey 2022 of over 19,000 respondents found 53% of respondents still had no life insurance or any other protection policy, a slight improvement from 54% in 2020.

However, the survey also found 84% of adults held at least one general insurance product in 2022 – down from 86% in 2020.

While the most‑commonly held insurance policies were motor (64%), home contents (61%), buildings (54%) and motor breakdown cover (49%), protection product rates were much lower, with just 29% covered by life insurance, down from 30% in 2020.

Private medical insurance (PMI) and critical illness policies were both held by 13% of respondents, unchanged from 2020.

Almost one in ten (9.1%) respondents benefitted from health cash plans in 2022 compared with 7.7% in 2020 and 6.1% were covered by income protection, up from 5.3% over the same period.

Policy cancellations

The report also contained findings from a January 2023 survey where respondents were asked whether they had stopped saving, used their savings to cover day-to-day expenses, cut back on their pension contributions, cashed in a pension to cover daily expenses, or cancelled any insurance or protection policies to save money, as a direct result of the rising cost of living.

In all 13% of policyholders surveyed had cancelled or reduced the level of cover on an insurance or protection policy to save money.

And in the six months to January 2023, one in eight adults (13%) who were insurance or protection policyholders in May 2022 cancelled at least one of their policies (8%) or reduced the level of cover on at least one of their policies (7%), specifically to save money due to the rising cost of living.

Mistrust of financial services

But the report also shone a light on the FCA’s incoming Consumer Duty, with the survey showing 14% of respondents had unsuccessfully attempted to contact one or more of their financial services providers in the 12 months before May 2022, with the most vulnerable in society most likely to struggle.

However half (49%) were able to find the information or support they needed in another way.

Over the same period, 7% of respondents were able to contact one of their financial services providers but could not get the information or support they wanted.

A similar number (8%) said they received information from their provider that they could not understand, was not what was needed or was not timely.

Less than half of UK adults had confidence in the UK financial services industry and just 36% agreed that most financial firms were honest and transparent in the way they treated them.

Although a more positive picture emerged when people were asked to rate their own provider rather than the sector in general.

The regulator’s findings come ahead of the 31 July deadline for the introduction of the Consumer Duty.

The duty will require firms to act to deliver good outcomes for consumers and, in turn, help to improve trust and confidence in the financial services sector.