The government’s reversal of its National Insurance Contributions (NICs) hike to fund the health and social care levy will hit the UK’s coffers to the tune of more than £65bn over the next five years.

Addressing Parliament, chancellor Kwasi Kwarteng confirmed in his mini budget that April’s 1.25% rise in NICs will be reversed from 6 November.

Government further revealed that the planned levy to fund health and social care will be axed, with funding for health and social care now coming from general funding, which is likely to come from a substantial increase in borrowing.

The move has also been criticised for wasting time and money for firms implementing the original changes, and for benefitting higher earners more than lower earners.

In the blue book accompanying the chancellor’s Growth Plan, HM Treasury revealed the overall costs of the exchequer of the NI hike repeal.

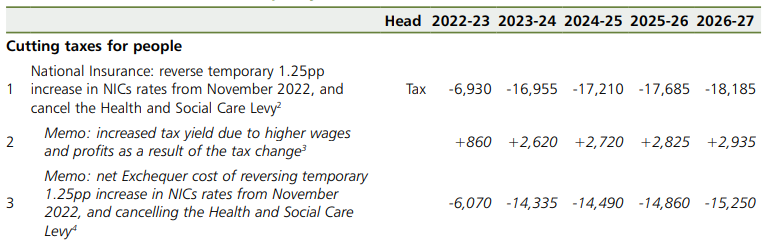

Broken down, in 2022/23 the predicted cost in lost NICs would be £6.93bn, although it does expect to receive a small increase of £860m through higher wages and profits, but this would still amount to a £6.07bn overall hit to revenues for the year.

This figure would more than double in each of the next four years to more than £14bn in lost NICs per year – totalling an overall, the cost to the exchequer of £65bn.

This reversal will be delivered in two parts, according to HM Treasury.

National Insurance rates will be reduced from 6 November, in effect removing the temporary 1.25 percentage point increase for the remainder of the 2022-23 tax year.

The 1.25% Health and Social Care Levy will not come into force as a separate tax from 6 April 2023 as previously planned.

This tax cut reduces 920,000 businesses’ tax liabilities by £9,600 on average in 2023-24, which is 60% of the UK’s businesses with employer NICs liabilities, HM Treasury said.

Needless work to implement levy

Andrew Tully, technical director at Canada Life, claimed the significant work and money spent in planning for the health and social care levy have all been for nothing.

“There will have been a significant amount of money spent in planning for the new levy, announced around a year ago,” Tully said.

“The temporary increase in NI was introduced due to the significant development work needed to implement a completely new tax and much of that will have been spent, now needlessly,” he continued.

“While the new levy wouldn’t have solved the social care funding issue the country faces, it did at least recognise the issue and start to work towards solutions. That dilemma of how to pay for social care remains hanging over the country.”

Steve Herbert, wellbeing and benefits director at Partners&, added the move would save higher rate taxpayers more than basic rate and would be a significant cost saving to employers and would also affect salary sacrifice calculations.