While Stephen Hough is currently enjoying retirement, he is not completely ruling out yet another comeback.

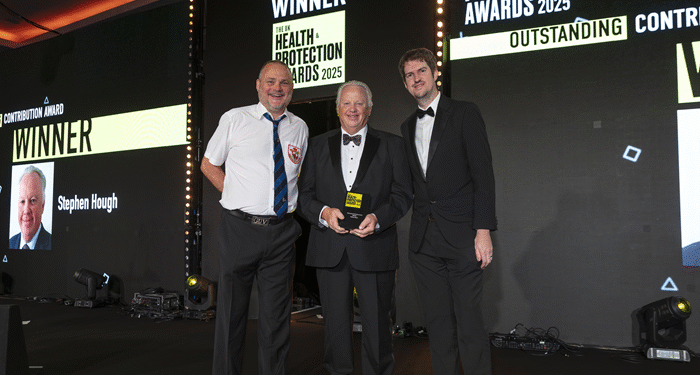

Following a long career and two retirements, Hough (pictured centre) was recognised for his outstanding contribution to the health and protection industry at the Health & Protection Awards 2025 last month.

Speaking to Health & Protection following his Award win, Hough reveals he had no idea he was being recognised on the night and why he has enjoyed watching the successes of former colleagues he has helped along the way.

He also touches on why private medical insurance (PMI) needs to be watchful that it does not become too costly for customers, and why this latest retirement is probably most definitely, but might not be, the end of his time in the sector.

“I had no idea that I would even be considered for an award so I was genuinely very grateful for the invitation, having finished at the end of March,” Hough tells Health & Protection.

“As the award was being announced I had no idea but as it got to the bit about ‘growing one of the biggest current brokers’ I realised it could be me and then shivers went down my spine as Al said about retiring three times.

“It was such a surprise and very much appreciated.”

Supporting and growing colleagues

In his early career Hough led Leicestershire-based TF Bell to become a firm writing £15m of premium every year.

In 2008 the Towergate Partnership bought TF Bell with Hough as chief executive transferring along with the rest of the team.

He stayed with Towergate for a decade including two years as business director before leaving in 2018.

He then returned to the industry in spring 2021 as managing director of Premier Choice Healthcare and was a key part of the firm’s growth strategy following takeover by Brown & Brown ahead of his retirement earlier this year.

“The proudest I feel is seeing people I have worked with doing well in their career and hope that in some way I may have played a small part in guiding them along the way,” Hough says.

“This is from right back in the days of The TF Bell Group where Mark Lilley was my finance support and has now gone on to be an operations director at Towergate.”

Hough also points to former colleagues Paul Bridges and Zanele Sibanda who have both gone on to win industry awards as well as Darren Perkins who Hough first met in 2016 while working with him at Towergate and then again at Premier Choice.

“Without Darren I would not have achieved the success at what is now Brown & Brown,” Hough continues.

“So in truth the people are what I think are my greatest achievements and what I am certainly proud of.

“There are of course many other colleagues that I would like to think that I have helped along the way too.”

Continuous learning and trust in people

When asked about his most important mentor over his career, Hough adds he has not had one, but has always retained a willingness to continue learning.

“I listened to everybody, taking onboard their experiences to guide my own path,” he continues.

“What I did have was people around me who I could trust so that we could discuss issues and as the saying goes ‘a problem shared’ was often the solution or at least the start of a solution.

“In the latter days I would quite often have a two hour drive home and spend the whole time talking to Darren which solved many issues and created numerous great ideas too.”

Biggest changes and challenges

Touching on the challenges the industry faces, Hough reflects that while every business in the sector tries to reinvent the wheel, the industry operates in the same way as it always has between clients, brokers, and insurers.

“The challenges that come along are normally driven by economics or problems in the NHS, but what has changed is the add-ons for products and what service clients need from their brokers as more is expected nowadays,” Hough continues.

“The biggest change definitely came with the pandemic now that we are all using video conferencing, although it is still important to have face to face discussions to get a true feeling of client needs and the same goes for insurers too.”

Looking ahead, Hough thinks the biggest challenge seems to be affordability for customers.

“It’s the danger that the medical insurance costs could price itself out for some consumers and businesses, yet it is becoming more essential with added pressure on the underfunded NHS,” Hough continues.

Definitely the end?

As for what he will miss most about work, while Hough points to the people – whether that be clients, insurers or colleagues, now he is retired, this time he intends to keep it that way.

“Having tried retirement twice already I do not have any great plans other than some golf and more time with my granddaughter,” Hough adds.

“Is this the end of my working life? I would like to think so, but I also thought that back in 2012 and 2018, so never say never.

“However, my wife’s answer would definitely be this is the end,” he adds.