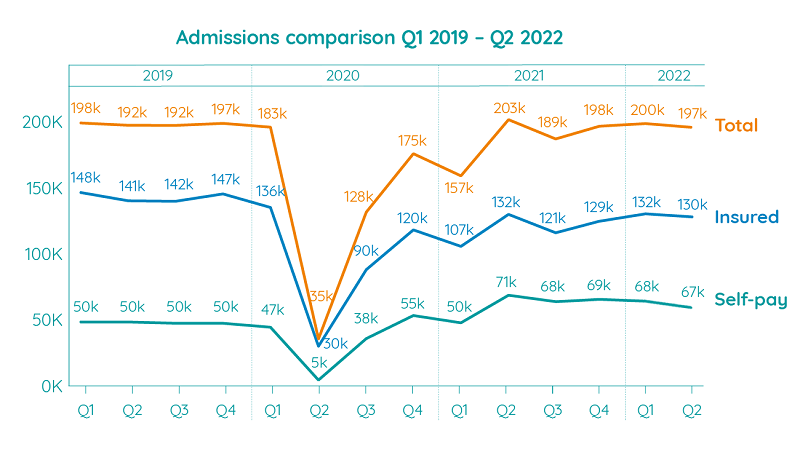

The number of people receiving treatment through private medical insurance (PMI) dipped in the second quarter of this year and appears to have plateaued notably below pre-pandemic levels.

According to latest figures from the Private Healthcare Information Network (PHIN), the number of people receiving treatment on an insured basis dipped slightly to 130,000 from April to June.

This was down from 132,000 in the previous quarter, but crucially was around 8% lower than the 141,000 treated in the same period in 2019 and appears to indicate a flattening of the market in this regard. (See graph below, source PHIN)

In contrast the self-pay market remained well above its pre-pandemic level as more people continued to pay for their own treatment.

As a result, overall private health admissions of 197,000 were down slightly from the previous quarter but continued to track just above the level of three years ago.

The number of consultants actively treating private patients was largely consistent with Q1 2022.

However, this is below the same period in 2019 and it appears as many as 1,000 consultants may have left the private healthcare market.

The data includes day case and inpatient treatment but does not include outpatient diagnostics and mental health.

Self-pay soaring

The PHIN data showed 67,000 were admitted on a self-pay basis – up more than 30% from the reciprocal quarter in 2019.

London and the South East remained the most active self-pay markets with 13,795 and 10,005 admissions respectively. All of these areas saw growth of at least 12% compared to Q2 2019.

However the largest growth over this period came in Wales which soared 90% to 3,540 admissions, Scotland which rose 69% to 4,905, and the East Midlands which was up 60% to 3,100.

Cataract surgery was once again the largest area of activity for self-pay with 11,525 procedures completed – up 42% on Q2 2019.

However, in terms of growth, hip replacement (up 184%), knee replacement (up 153%) and inguinal hernia repair (up 123%) procedures had the highest increases.