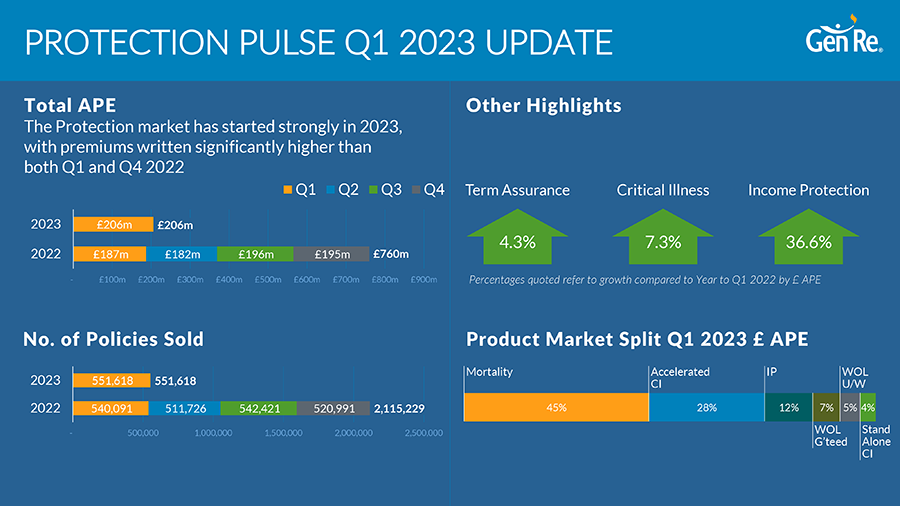

More than eleven and a half thousand more protection policies were sold in the first quarter of the year when compared with the same period in 2022, according to Gen Re.

The reinsurer’s Protection Pulse update showed that 551,618 policies were sold in Q1 2023.

This was 2% higher than the 540,091 polices completed in Q1 2022 and 6% higher than the 520,991 policies sold in Q4 2022.

Total annual premium equivalent (APE) also rose to £206m, compared with £187m in Q1 2022 and £195m in the final quarter of 2022.

Across product group in terms of APE, income protection saw a 36.6% increase on the corresponding quarter of last year, while critical illness and term assurance posted 7.3% and 4.3% increases over the same period respectively.

In terms of product market split, mortality accounted for 45%, with accelerated CI comprising 28% of the market.