Pulse Insurance is launching a cancer protection product featuring a lump sum payment and support services. It is backed by reinsurance managing general agent Rokstone and Reframe Cancer.

The product is available initially for employer schemes through a variety of methods including whole of workforce and flexible benefit or opt-in options. An individual product is being developed.

Pulse is looking to work with distrbution partners including advisers, intermediaries and employment benefit consultants rather than distribute the scheme directly.

Key features include three levels of lump sum pay-out upon first diagnosis for 95% of cancers, access to a personalised cancer care plan with support and guidance through both the NHS and private cancer pathways.

It offers up to 16 hours of emotional and practical support from a dedicated cancer nurse and cancer support manager and pre-diagnosis support to guide policyholders to make healthy lifestyle choices which may prevent cancer, as well as providing awareness of symptoms that could need investigating.

The scheme is aimed at the younger working-age population amid a rise in cancer diagnoses among those in their 30s and 40s.

Group sizes for the workplace product start at a minimum of two with no maximum number of members.

Underwriting has been kept to a minimal approach: customers must be aged between 18 and 64 years old and have no previous diagnosis of cancer, or brain, spinal cord, or meninges tumour of any kind.

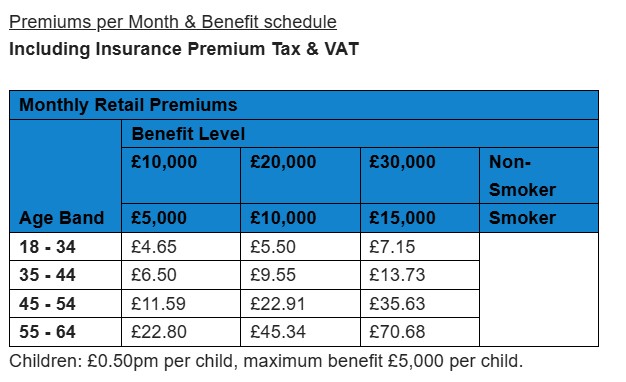

Anyone who has used tobacco products over the last three years will only be eligible for 50% sum assured cover.

The three levels of sum assured for standard cover are £10,000, £20,000 or £30,000. (see table below)

A Pulse spokesperson told Health & Protection the UK-based scheme will not cover longer term prostate cancer, some minor skin cancers or customers who have had cancer before.

Ben Broom, head of Pulse Clarity, said: “Traditionally people have tended to consider policies like critical illness and life insurance when they first take out a mortgage, but the rising average age of first time buyer homeownership in the UK means fewer people discuss these critical covers early, leaving them vulnerable, especially against the backdrop of lengthy NHS waiting lists and regional variations in cancer treatment.

“There is a clear and urgent need for this product. Rokstone is a true expert in the medical underwriting sphere with vast knowledge and the size and scale to be a formidable partner for this launch.

“We’re delighted to be partnering with them and Reframe Cancer to launch this scheme.“

Aventum, Rokstone’s parent group, has successfully trialled the scheme with its own 500+ employees ahead of a nationwide rollout.

Rokstone’s accident and health (A&H) division is led by underwriters Darren Delande and Hywel Jones.

Delande said: “A&H has been a difficult market for brokers in recent years with a severe lack of capacity and limited underwriters who are true specialists.

“We give brokers that expertise, backed by a global, successful, data led MGA with a sterling reputation. We’re proud and delighted to play our part in bringing this vital scheme to market.”

Mark Stephenson, CEO at Reframe, added: “Over the past decade, we’ve built a reputation for developing best-in-class cancer navigation and support solutions for the insurance and employer sectors.

“Our latest collaboration with Pulse Insurance leverages this expertise to deliver a groundbreaking insurance solution and we’re thrilled to partner with them on this ambitious journey.”